What is a Master Promissory Note?

A master promissory note (MPN) is a legally-binding document that governs all federal student loans you receive from the Department of Education. It includes details on your loan interest rates, repayment terms, and borrower benefits.

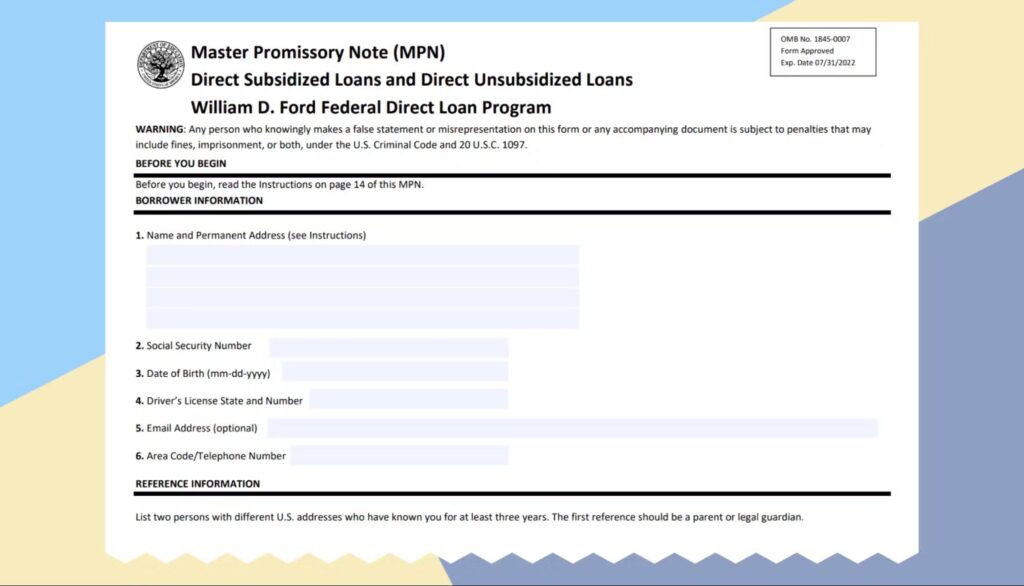

Master promissory notes work as legally binding agreements between the borrower and the federal government. The borrower’s responsible for executing a Master Promissory Note (MPN) before they receive loan funds disbursed to their school. The school may remind students about this as part of their financial aid checklist, but the MPN must be completed and submitted directly by the borrower. The MPN will include details about your loans, such as your interest rates and loan repayment responsibilities. It will also detail your rights and responsibilities as a borrower, including deferment/forbearance options and loan forgiveness opportunities.

The MPN will be used for federal Direct Subsidized and Unsubsidized Loans for undergraduate students and for the Direct PLUS Loan for graduate or professional degree students or parents of eligible undergraduate students. In addition, an MPN can be used for multiple years of borrowing for each specific loan program. The MPN process is complete online and requires your Federal Student Aid (FSA) ID to act as an electronic signature. MPNs are valid for up to 10 years, so you may only have to complete one each year you want to borrow federal student loans. It’s important to know the difference between an MPN and a regular promissory note so you’re not confused when completing your MPN.

Is the Master Promissory Note Mandatory?

When borrowing from the federal government, you must complete a Master Promissory Note (MPN) before funds can be disbursed. The MPN is an online contract that you execute with your FSA ID. It asks you for the names and contact information of two references who can confirm your identity and address. This information is used to prevent fraud and locate you if you default on your loan.

The MPN covers several aspects of your federal student loans, including grace periods, interest rates, repayment options, and forgiveness options. It also outlines legally binding practices around privacy rights and how to borrow responsibly.

You must complete an MPN before each year you borrow to authorize your school to credit your account with the appropriate amounts of Direct Loan funds. Talk to your school’s financial aid office about the MPN process. The school will tell you which types of federal loans you’re eligible to receive and how much each year.