How to Register for a Texas Sales Tax Permit?

If you're starting a business in Texas, you need to understand how to register for a sales tax permit. This is a crucial step for ensuring that your business collects and remits sales tax accurately.

A Texas sales tax permit allows you to charge state and local taxes on your products or services. The state requires that you display the permit conspicuously at your business location and keep records of your sales tax collections and payments. The state also requires that you file returns monthly or quarterly, depending on how much you sell. If you want to make this process easier, you can use a service to manage your sales and use tax filings for you.

Any individual, partnership, or corporation that sells tangible personal property or taxable services in Texas must register for a sales tax permit. This includes businesses that operate from a location outside of the state but have nexus in the state because of their product fulfillment facilities or other business activities in Texas. The registration process is simple; you can do it online or by mailing the application to the state. Before submitting your application, make sure that you have all the necessary documents. These include your business name, address, a description of your goods or services, and the social security number for each owner of the business (for sole proprietorships) or federal employer identification numbers (for partnerships) and North American Industrial Classification Code (NAICS) for corporations.

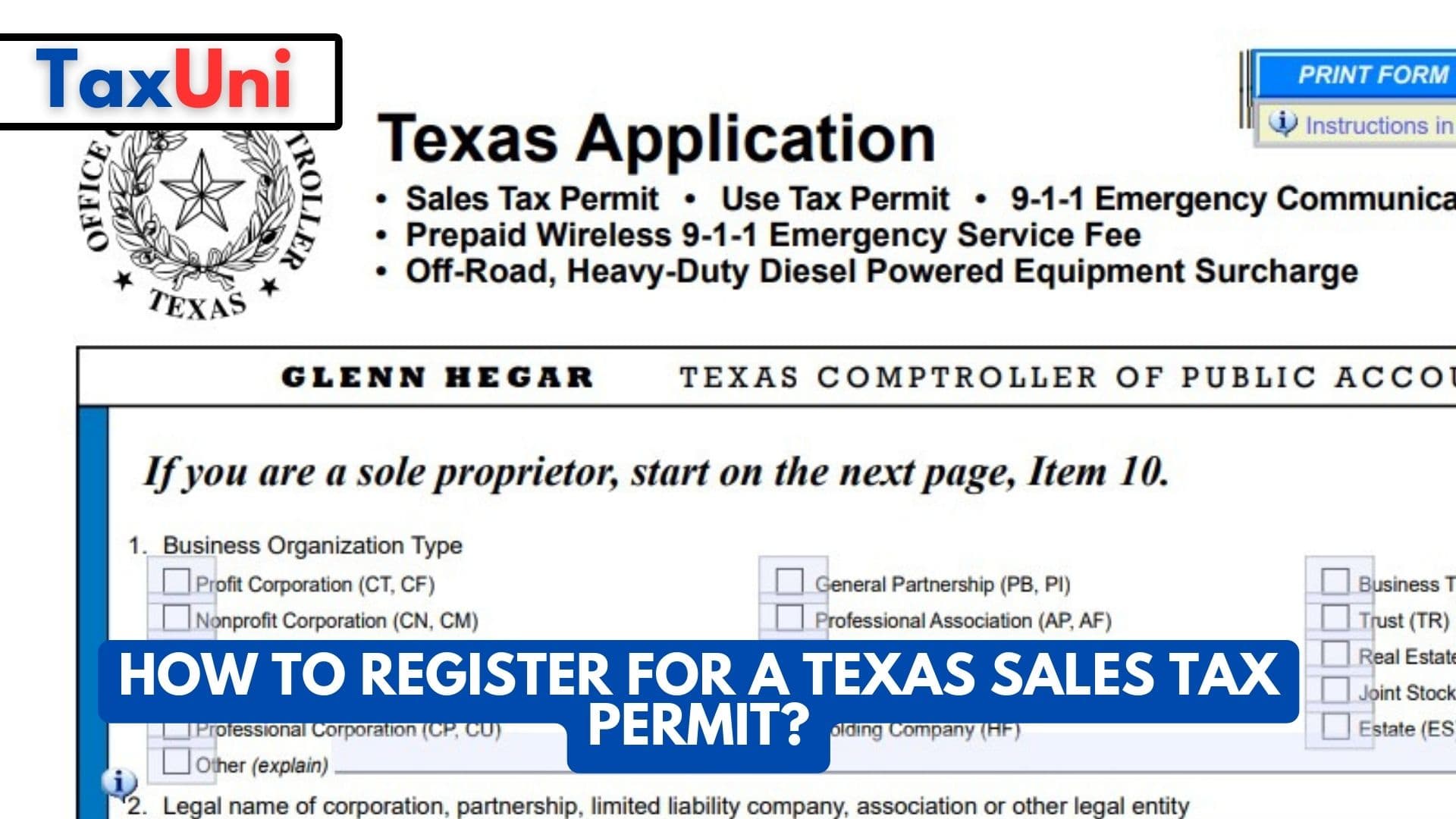

How to Apply for a Texas Sales Tax Permit?

The first step is to complete a Texas tax registration application, or AP-201, which you can do by visiting the Texas Comptroller website.

To apply for a sales tax permit in Texas, you must provide the following information. For a sole proprietorship, the owner’s Social Security Number (SSN) or Federal Employer Identification Number (FEIN). For partnerships, the partnership name and the SSNs or FEINs of all partners. For corporations, the corporate file number is issued by the Secretary of State and the North American Industrial Classification code. Out-of-state sellers who sell taxable goods or services in Texas must also register for a Texas sales tax permit if they have an “affiliate nexus” with another company that has a physical presence in the state, such as a warehouse, storage yard, or distribution center.

You can choose to file monthly or quarterly. Monthly filings are due on the 20th of each month, while quarterly filings are due on the last day of the quarter. Once you have completed the AP-201, you will receive your sales tax ID, filing frequency, and WebFile number via mail. You can also check the status of your application by logging into your account on the Texas Comptroller website. You can also call the Texas Comptroller’s helpline if you have any questions. In addition, if you have a sales tax permit in Texas, you must also file a franchise tax return with the state.