W2 Form Wage and Tax Statement

Contents

Employers must file Form W-2, Wage and Tax Statement for every employee that received $600 or more during the tax year in wages, salaries, and tips. This tax form is an information return that’s then used by the employee to report their income. So, it is crucial for employers to act in a timely manner, file Form W-2, and furnish the appropriate copy to their employees. Otherwise, not only the employer will be subject to monetary penalties, but the employee won’t be able to file their tax returns as quickly.

This article will go over everything you need to know about Form W-2, how to file it, provide you with an online fillable copy PDF, and answer commonly asked questions.

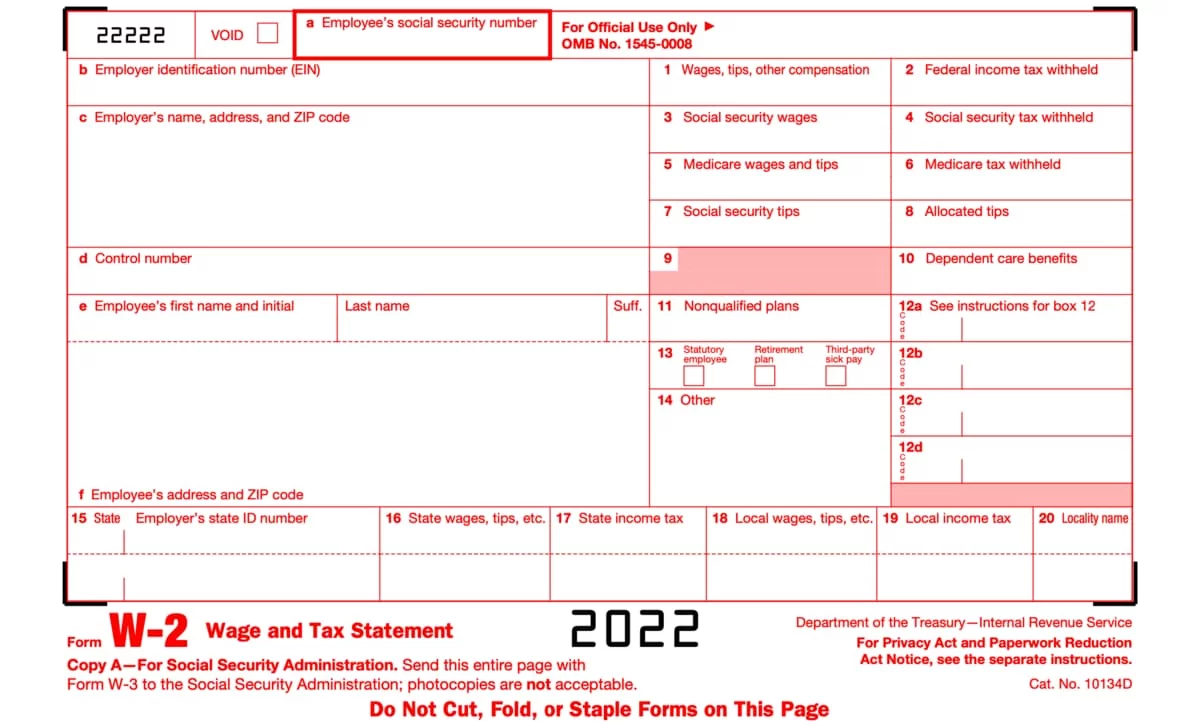

Form W-2 online fillable copy (paper version)

Below, you can start filling out an online copy of Form W-2 if you’re filing them on paper. This version of Form W-2 is basically the same as paper filing, but instead of entering information on a paper copy, you’re doing it on your computer and printing out a paper copy once completed.

How to file Form W-2

Using the TaxUni PDF Filler, use the navigations button above to enter money amounts and other information on Form W-2.

Things to know before filing Form W-2

First and foremost, Form W-2 is not filed with the Internal Revenue Service. Instead, it is filed with the Social Security Administration and state and local tax departments. You will then file a copy for yourself, for the employee’s federal and state income tax returns, each, and for the employee’s records. Each of these copies of Form W-2 is mandatory to file for employers.

Although filing different copies of the same tax form may sound time-consuming, it isn’t in reality. The details required on each form is pretty much the same from money amounts to personal information.

FAQs on Form W-2

When is the deadline for Form W-2?

The deadline to file Form W-2 is January 31 for furnishing employees with a copy of their Wage and Tax Statement. For Social Security Administration, it is February 28. Make sure to file Form W-2 before these dates to avoid potential monetary penalties.

What happens if I miss the deadline to file?

There are monetary penalties for Form W-2 in case you file it late or wilfully ignore to file it. For example, when you miss the January 31 deadline, you are subject to a minimum $50 penalty per violation for Forms W-2 filed within 30 days after the deadline. If you don’t file it within 30 days after the deadline, the penalty is then increased to $110 per violation. From there it goes all the way up to $270 per violation after August and more than $500 per violation for ignoring to file it.

Can I file Form W-2 before the tax year ends?

Employers may file Form W-2 before the tax year ends if they’re sure they not going to employ the same person again. That’s why the Internal Revenue Service publishes the new versions of Form W-2 for every tax year at the beginning of the year. File Form W-2 within a week or two after the employee is terminated or quits their employment.

How to file Form W-2 electronically?

There are several ways to file Form W-2. One way to go about is through the business management software you use if any. Many of these act as lifesavers where you can generate automatic copies of tax forms, including W-2. If you’re not using one, you can always file online copies of Form W-2 through the Social Security Administration’s Business Services Online (BSO) for free. Read more about it here.

How to order Form W-2 from the IRS?

The same as ordering any other tax form from the Internal Revenue Service, you can order full copies of Form W-2 from the agency. We recommend ordering Form W-2 towards the end of the tax year when the number of forms you need to file is determined. Otherwise, you would need to wait for another batch of Form W-2 or other tax documents, which can result in delays that can make you pay penalties.