W2 Form

The W-2 form plays a vital role in accurately reporting an employee's taxable income and ensuring compliance with tax regulations.

Contents

- Who Must File W-2 Form?

- When is the W-2 Form Due?

- How to File W-2 Form Electronically

- How to File W-2 Form by Mail

- How to Fill Out W-2 Form

- FAQs

- Who is responsible for providing a W-2 Form to employees?

- When is the deadline for filing W-2 Forms?

- How can employers file W-2 Forms electronically?

- How can employers file W-2 Forms by mail?

- What information is required on the W-2 Form?

- What should employees do if they receive an incorrect W-2 Form?

- How long should employees keep their W-2 Forms?

The W-2 form, also known as the Wage and Tax Statement, is an official IRS document that employers must provide to their employees annually. It summarizes an employee’s earnings and taxes withheld from their paycheck during a specific tax year. This information is crucial for employees to accurately file their federal and state income taxes.

Who Must File W-2 Form?

Employers are legally obligated to provide a W-2 form to every employee they pay wages, salaries, or other compensation amounting to $600 or more during the tax year. This includes full-time, part-time, temporary, and seasonal employees. Even if no federal income, Social Security, or Medicare taxes were withheld, employers must still issue W-2 forms to eligible employees.

When is the W-2 Form Due?

Employers must file W-2 forms with the Social Security Administration (SSA) and provide them to employees by January 31st following the end of the tax year. The SSA uses the information on W-2 forms to track employee earnings and determine their eligibility for Social Security benefits. Employees need their W-2 forms to accurately file their federal and state income taxes.

How to File W-2 Form Electronically

Employers can electronically file W-2 forms through the SSA’s Employer W-2 Filing Instructions and Information website. This method is secure, efficient and eliminates the need for paper forms. To file electronically, employers must create a Secure Sockets Layer (SSL) certificate and register with the SSA. Once registered, employers can upload their W-2 data using the SSA’s online filing system.

How to File W-2 Form by Mail

Employers can also file W-2 forms by mail using the IRS’s FIRE system. To file by mail, employers must obtain pre-printed W-2 forms from the IRS or purchase them from a commercial vendor. Employers must complete the forms accurately and legibly and mail them to the SSA’s designated address.

How to Fill Out W-2 Form

The W-2 form consists of six copies, each serving a specific purpose:

- Copy A: This copy is intended for the Social Security Administration (SSA). It serves as the official record of an employee’s earnings and contributions to the Social Security system, which plays a critical role in determining eligibility for Social Security benefits upon retirement.

- Copy B: This copy is provided to the employee for filing their federal income tax return. It contains the employee’s total wages, federal income taxes withheld, and Social Security and Medicare taxes withheld, all of which are essential for calculating the employee’s tax liability.

- Copy C: This copy is also for the employee, but specifically for filing their state and local income tax returns. It contains the same information as Copy B but may also include additional details required by state and local tax authorities.

- Copy D: This copy is retained by the employer for their records. It serves as a reference for the employer’s payroll records and tax filings.

- Copy 1: This copy is also for the employer’s records but specifically intended for their tax filings. It contains the employer’s portion of Social Security and Medicare taxes paid on behalf of the employee.

- Copy 2: This copy is the employee’s personal copy for their own records. It serves as a reference for the employee’s earnings and taxes withheld and can be used for various purposes, such as applying for loans or verifying income for benefit applications.

In summary, the W-2 Form serves as a bridge between employers and employees, providing both parties with the necessary information to fulfill their tax obligations and make informed financial decisions. Employers must ensure the accuracy and completeness of the information provided on the W-2 Form, as any errors or omissions can lead to delays in tax processing and potential penalties. On the other hand, employees should carefully review their W-2 Forms and utilize the information to file their taxes accurately and on time.

FAQs

Who is responsible for providing a W-2 Form to employees?

Employers are responsible for providing a W-2 Form to all employees who have received $600 or more in wages, salaries, or other compensation during the tax year. This includes full-time, part-time, temporary, and seasonal employees.

When is the deadline for filing W-2 Forms?

Employers must file W-2 Forms with the Social Security Administration (SSA) and provide copies to their employees by January 31st following the end of the tax year.

How can employers file W-2 Forms electronically?

Employers can electronically file W-2 Forms through the SSA’s Employer W-2 Filing Instructions and Information website. To file electronically, employers must create a Secure Sockets Layer (SSL) certificate and register with the SSA. Once registered, employers can upload their W-2 data using the SSA’s online filing system.

How can employers file W-2 Forms by mail?

Employers can also file W-2 Forms by mail using the IRS’s FIRE system. To file by mail, employers must obtain pre-printed W-2 forms from the IRS or purchase them from a commercial vendor. Employers must complete the forms accurately and legibly, and mail them to the SSA’s designated address.

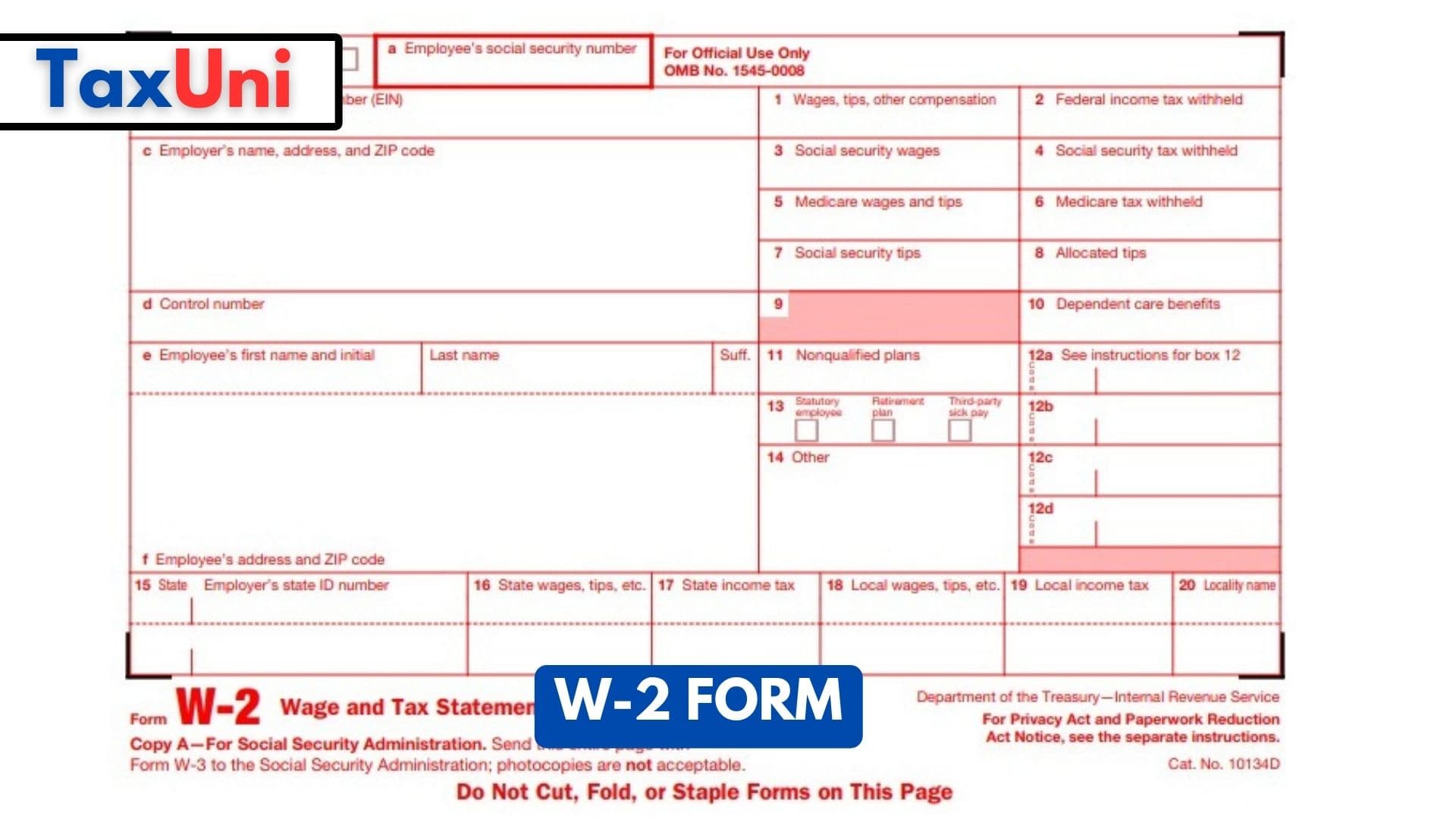

What information is required on the W-2 Form?

The W-2 Form requires employers to provide the following information about the employee:

– Employee’s name, address, and Social Security number

– Employer’s name, address, and employer identification number (EIN)

– Employee’s wages and salaries

– Federal income tax withheld

– Social Security and Medicare taxes withheld

– Additional compensation, such as tips or bonuses

– Employer-paid benefits, such as health insurance premiums

What should employees do if they receive an incorrect W-2 Form?

Employees should contact their employer immediately if they believe their W-2 Form is incorrect. If necessary, the employer will investigate the error and issue a corrected Form W-2C.

How long should employees keep their W-2 Forms?

Employees should keep their W-2 Forms for at least three years. This is because they may need them to file their taxes or for other purposes, such as applying for loans or verifying income for benefit applications.