IRS

The general information and documents that taxpayers need from the Internal Revenue Service. Learn announcements from the agency regarding your personal and business taxes.

-

Schedule A – Itemized Deductions Tax Form

The IRS Schedule A, Itemized Deductions, is the tax form used for itemizing deductions. If you have deductible expenses, itemizing…

-

Schedule 1 – AGI Tax Form

Schedule 1, Additional Income and Adjustments to Income, is a tax form that you must file with your federal income…

-

Multiple Jobs Worksheet for Form W4

Employees should file Form W-4, and sometimes, this is a multi-step process. If you’re holding more than one job at…

-

Schedule 3 – Online File PDF

Schedule 3, Additional Credits and Payments, is the IRS tax form used for claiming tax credits other than those shown…

-

Schedule 8812 2022 for Child Tax Credit – File Online

Schedule 8812, Credits for Qualifying Children and Other Dependents, is the supporting document for your federal income tax return –…

-

IRS Letter 6419

The Internal Revenue Service started sending out informational letters regarding the advanced payments of the child tax credit. If you’re…

-

IRS Letter 6575

Haven’t received your third stimulus check? Then there is a good chance that you’re able to claim the recovery rebate…

-

1040-X Form

Form 1040-X, Amended US Individual Income Tax Return, is your amended tax return. When you’ve filed your original tax return…

-

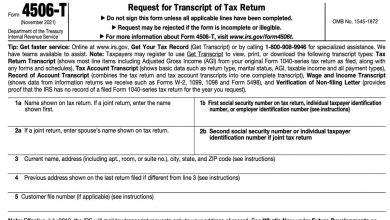

Form 4506-T

The first thing you should know if you’re self-employed and want to borrow money from a lender is that you…

-

IRS CP80 Notice

If you ever wonder what’s the IRS CP80 Notice, know that you’ve received it for a simple reason. The Internal…