How to Pay Your Taxes Online with the IRS?

If you owe taxes, you have a few options to pay them online. This article will discuss different online methods for tax payments.

Contents

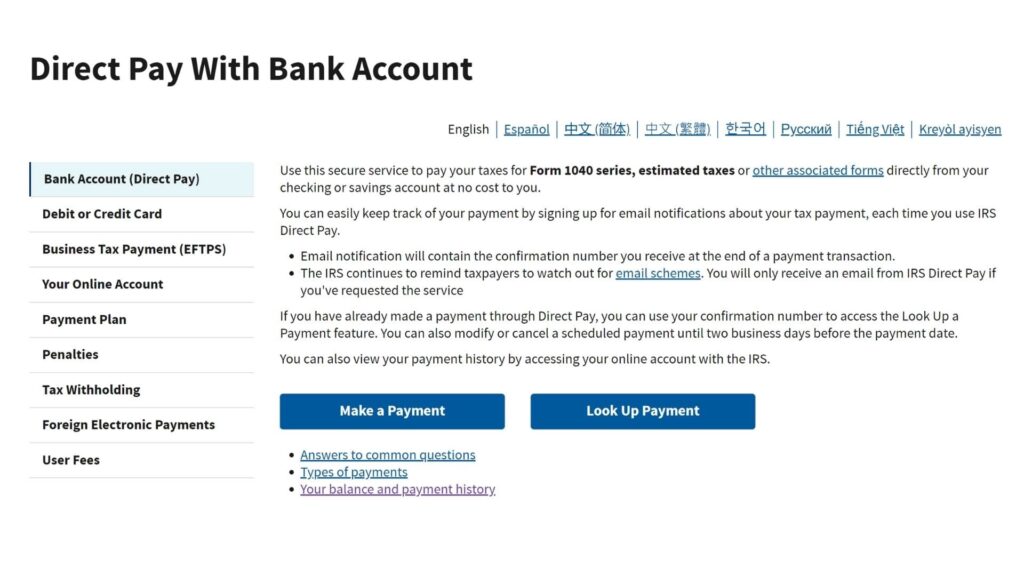

There are a number of ways to pay taxes online, including the IRS Direct Pay service. This free option allows individuals and businesses to make tax payments directly from their checking or savings accounts. It is safe, convenient, and easy to use. Users can sign up for email notifications and track their payment using the Look Up a Payment feature. Individuals can also make federal tax payments using a credit or debit card. This method can be used for income, employment, and excise taxes. In addition, individuals can use a tax preparation software program to withdraw electronic funds from their bank account. The IRS has more information on this process on its website.

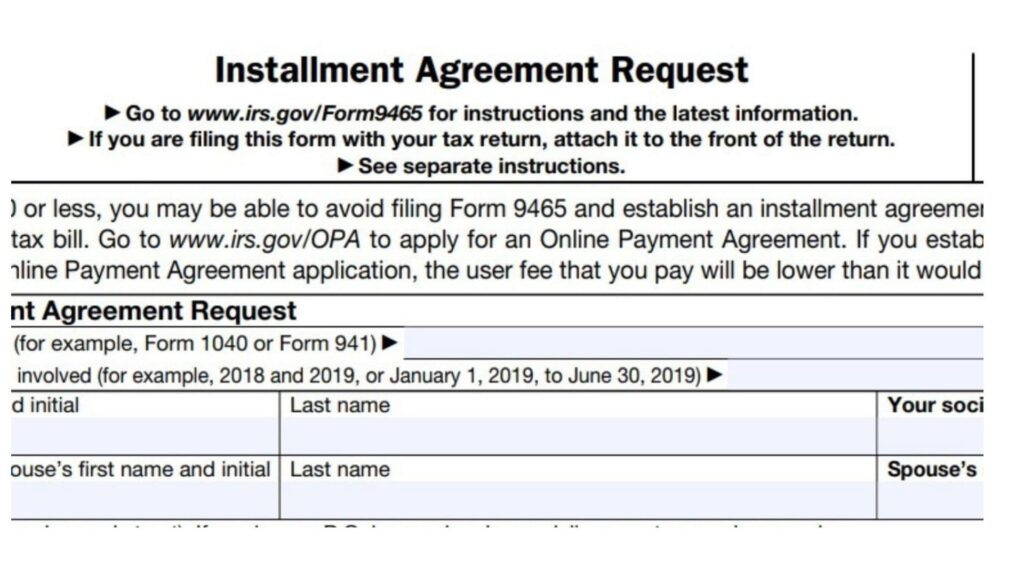

Those who are not able to pay their taxes in full can get help from the IRS by applying for a tax payment plan. Taxpayers can use the Online Payment Agreement tool (OPA) to apply for a plan, which includes an installment agreement. There is a user fee, but low-income taxpayers may be eligible for a reduced or waived fee.

IRS Direct Pay

IRS Direct Pay is an online payment method provided by the Internal Revenue Service (IRS) in the United States. It allows taxpayers to make secure and convenient electronic payments directly from their bank accounts for various tax obligations. With IRS Direct Pay, individuals and businesses can make payments for income taxes, estimated taxes, installment agreements, and other tax liabilities.

IRS Direct Pay is a free service offered by the IRS. There are no fees or charges associated with using this payment method. Taxpayers can access IRS Direct Pay through the official IRS website. The system guides users through a simple step-by-step process to make their payment. Taxpayers must provide their personal information and bank account details for verification purposes. This ensures that payments are securely processed from authorized accounts.

IRS Direct Pay allows taxpayers to schedule payments in advance, making it convenient for those who prefer to plan their tax obligations in advance or set up recurring payments. After successfully submitting a payment through IRS Direct Pay, taxpayers receive immediate confirmation of the transaction. This confirmation includes a payment confirmation number and other relevant details.

OPA Tool

The Online Payment Agreement (OPA) tool is a service provided by the Internal Revenue Service (IRS) in the United States. It is an online application that allows taxpayers to set up installment payment plans for their tax liabilities when they are unable to pay the full amount owed at once. The OPA tool enables individuals and businesses to request and establish a payment plan based on their financial situation with the IRS. It offers a convenient and streamlined process for arranging monthly installment payments to satisfy their tax debt.

The OPA tool is accessible through the official IRS website, making it convenient for taxpayers to initiate and manage their payment agreements online. Taxpayers must meet certain eligibility criteria to use the OPA tool. Generally, individual taxpayers with a balance of $50,000 or less and businesses with a balance of $25,000 or less can qualify for an installment agreement through the OPA tool.

The tool offers various payment options, allowing taxpayers to choose the most suitable installment plan based on their financial circumstances. Payments can be made monthly via direct debit from a bank account or through other methods such as check or money order. The OPA tool guides taxpayers through a step-by-step process to provide the necessary information and set up their payment agreement. It calculates the minimum monthly payment based on the amount owed and the proposed repayment term.

IRS2Go App

IRS2Go is a mobile application developed by the Internal Revenue Service (IRS) in the United States. It is designed to provide taxpayers with convenient access to a range of tax-related information and services directly from their smartphones or tablets. The IRS2Go app offers several features and functions to assist taxpayers with their tax obligations. Here are some of its key functionalities:

- Taxpayers can check the status of their federal tax refund using the app. By entering their Social Security number, filing status, and refund amount, they can receive real-time updates on the progress of their refund.

- The app allows users to make tax payments directly from their mobile devices. Taxpayers can choose to pay through direct debit from their bank accounts or use a debit or credit card to fulfill their federal tax obligations.

- IRS2Go provides access to various tax resources and tools to assist taxpayers. It offers tax tips, FAQs, publications, and tax news updates to help individuals stay informed about tax-related matters. The app also provides access to the Volunteer Income Tax Assistance (VITA) program, which offers free tax preparation assistance to eligible individuals.

- Users can request and view their tax return transcripts and tax account transcripts through the app. Tax transcripts are useful for verifying past tax return information or addressing specific tax-related issues.

- The app features tools and resources to help protect taxpayers’ identities and prevent tax-related fraud. Users can access the Identity Protection PIN (IP PIN) tool to obtain or reset their IP PIN, which adds an extra layer of security to their tax returns.

- IRS2Go enables users to subscribe to IRS news and updates, ensuring they receive timely notifications about important tax deadlines, changes in tax laws, and other relevant information.