Form 941 Schedule B

Contents

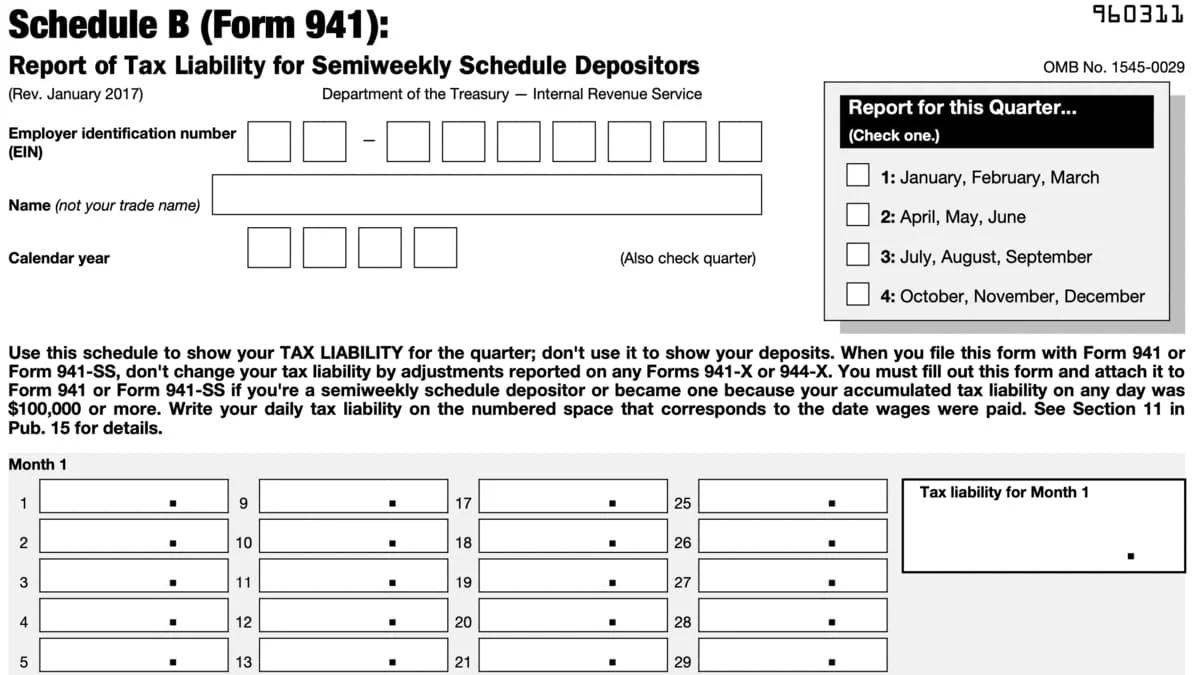

Schedule B of Form 941 is an attachment of your Quarterly Federal Tax Return. File it with your Form 941 to report federal income taxes withheld for each month of the quarter.

Don’t mistake this tax form with the Schedule B of 1040, Interest and Ordinary Dividends. Schedule B for Form 1040 and 941 are two different tax forms, although they are named the same.

What is Schedule B?

Use Schedule B to report federal income taxes withheld from your employees’ income on a daily basis. This tax form basically reports your tax liability for the federal income taxes withheld from your income.

Who must file Schedule B with Form 941?

All semi-weekly schedule depositors are required to file Schedule B with their Forms 941. Employers that reported more than $50,000 during a quarter or accumulated a tax liability of more than $100,000 are semi-weekly schedule depositors. File Schedule B with your Form 941 for every quarter of 2024 if it applies to you.

Online fillable Schedule B

The same as 941 Form 2023, you can file Schedule B of the form online using our PDF Filler. This is an alternative to filing Form 941 on paper. Fill out Schedule B and Form 941 itself on your computer and print out a paper copy with the information entered. You can then mail 941 and Schedule B to the Internal Revenue Service with your money order or check order if you’re not paying them electronically.

Get Form 941’s Schedule B below.

IRS Form 941 Schedule B Instructions

On Form 941 Schedule B, start by entering your personal information: Employer Identification Number, Full Name, and enter the calendar year. Then, check the quarter that you’re filing Form 941 Schedule B.

From there, enter your tax liability for each day for the month that the wages were paid. You don’t need to enter tax liability for every single day of each month. Only enter on the boxes that the wages were paid for that pay period. For example, if you’re paying your employees weekly, you should enter tax liability on four or five boxes for each month.

Get the 941 Form 2024 Instructions to File

Filling out Schedule B of 941 for the 2024 tax year is quite simple, but gathering all the information can be challenging. We highly suggest using business management software to handle these as it will cut down the time it takes to figure out money amounts for each box. The same also goes for any other tax form that you’re reporting payroll, like W-2s and 1099s.

How to complete Form 941 Schedule B?

Completing Form 941 Schedule B accurately is crucial for employers to avoid penalties and ensure proper tax reporting. Here are the steps to complete the form:

- Step 1: Provide employer information Enter the employer’s name, address, and employer identification number (EIN) in the designated fields on Form 941 Schedule B.

- Step 2: Enter the quarter and year Specify the quarter and year for which you are filing Form 941 Schedule B.

- Step 3: Report the number of employees Enter the total number of employees who received wages, tips, or other compensation during the quarter. This includes both full-time and part-time employees.

- Step 4: Breakdown of taxes withheld Provide a breakdown of the federal income tax, Social Security tax, and Medicare tax withheld from employees’ wages during the quarter. Report these amounts for each employee individually or summarize them.

- Step 5: Backup withholding information If backup withholding was required during the quarter, report the total amount of backup withholding in the appropriate section.

- Step 6: Total taxes after adjustments Calculate the total taxes owed after adjustments, taking into account any adjustments made to the reported wages or taxes withheld.

- Step 7: Sign and date the form Ensure the form is signed and dated by an authorized person.