What to Do If You Receive Form W-2C: A Step-by-Step Guide

This article will guide you through the necessary steps to take upon receiving Form W-2C.

Contents

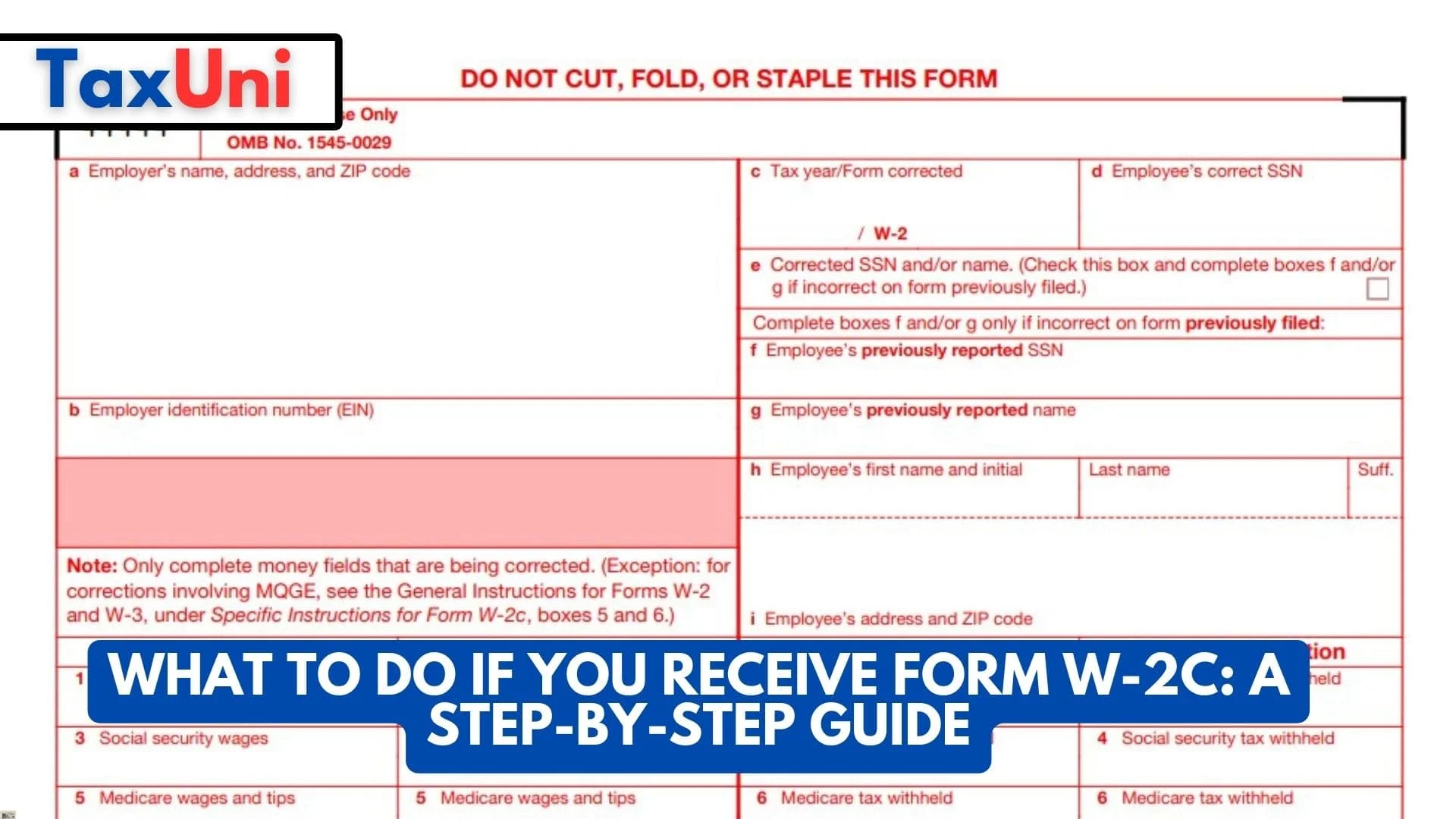

Receiving a Form W-2C, or Corrected Wage and Tax Statement, can be concerning for employees who have already filed their tax returns. This form is issued by employers to correct errors made on the original Form W-2, which reports an employee’s annual wages and tax withholding. Understanding how to handle a W-2C is crucial to ensure your tax return is accurate and compliant with IRS regulations. Form W-2C is used to correct mistakes on the original Form W-2, such as:

- Incorrect employee name or Social Security number

- Mistakes in reported earnings or tax withholdings

- Errors in the employer’s identification number (EIN)

- Incorrect tax year reported

The form contains two columns for each wage and tax item: one for previously reported amounts and another for corrected amounts.

Steps to Take Upon Receiving Form W-2C

1. Review the Changes

Carefully examine the information on Form W-2C. Compare the corrected amounts with those reported on your original Form W-2. Pay particular attention to:

- Total wages

- Federal income tax withheld

- Social Security and Medicare taxes

Understanding what has changed will help you determine whether you need to amend your tax return.

2. Determine If You Need to Amend Your Tax Return

If you have already filed your tax return using the original Form W-2, you may need to file an amended return (Form 1040-X) if:

- The corrected amounts on Form W-2C affect your taxable income or tax liability.

If the changes do not impact your overall tax situation (for example, if the corrections are related to non-taxable benefits), you may not need to amend your return.

3. Filing an Amended Return

If you determine that an amendment is necessary, follow these steps:

- Obtain Form 1040-X: This is the form used to amend a previously filed individual income tax return.

- Complete the Form: Fill out Form 1040-X, ensuring that you include the corrected figures from Form W-2C. Indicate any changes in income, deductions, or credits based on the new information.

- Attach Supporting Documents: Include a copy of Form W-2C along with any other relevant documents that support your amendment.

- Submit Your Amended Return: Mail the completed Form 1040-X and supporting documents to the address specified in the form instructions. Note that amended returns cannot be filed electronically if you’re using paper forms.

- Keep Records: Retain copies of all forms and correspondence for your records.

4. If You Have Not Filed Your Return Yet

If you have not yet filed your tax return for the year indicated on Form W-2C:

- Use the corrected information from Form W-2C when preparing your return.

- Ensure that all figures are accurate before submitting your return to avoid further complications.

5. Consult a Tax Professional

If you are uncertain about how to proceed after receiving a Form W-2C or if your situation is complex, consider consulting with a tax professional or CPA. They can provide personalized advice based on your specific circumstances and help ensure compliance with IRS regulations.