Unemployment Tax

Unemployment taxes vary by state. Taxable income generally includes salaries and wages, commissions, bonuses, sick pay, vacation allowances, and contributions to retirement plans.

Getting unemployment benefits can provide the financial support you need to get back on your feet and find new work. But it’s important to remember that your unemployment income is taxable. Understanding how unemployment taxes work can help you plan ahead and reduce your tax bill when it comes time to file your return. Federal unemployment taxes (FUTA) are a payroll tax that helps fund state workforce agencies. Employers must report FUTA on their federal employment tax returns (Form 940). Unlike most other payroll taxes, workers do not pay FUTA directly. Instead, it’s the responsibility of employers to pay FUTA through withholding or estimated quarterly payments throughout the year.

Generally, the annual FUTA rate is equal to one-half of the average rate paid by all regular nongovernmental employers during the preceding calendar year. However, if the cash balance in the Unemployment Compensation Trust Fund is below a certain minimum level, the Department of Labor may apply an automatic experience rate adjustment (ERA). The contribution rates used to determine unemployment taxes vary from state to state. Each state’s UI tax rate is determined by the average reserve ratio of all employers in the state, with positive reserves earning the lowest rates and negative ones paying the highest.

The FUTA rate is also adjusted by the amount of contributions made to the Trust Fund during the previous year and the available reserve ratio. In addition, a Deficit Tax Rate (DTR) may be added for each experience-rated employer when the cash balance in the Trust Fund is below an established minimum level.

Which Type of Unemployment Tax Do I Have to Pay?

The type of unemployment tax you must pay depends on whether you have one or more employees, the number of weeks they work, and their wage amounts. Most employers are responsible for both FUTA and state unemployment insurance (SUI) taxes. You can use a calculator to find out how much your total unemployment tax liability is.

If you’re a new employer, you must register with your state’s unemployment agency and receive an experience rating. To calculate your rate, the state will divide your benefit liability by your taxable payroll over a period of three years. In addition, the department will consider any other taxable wage information you provide, such as your industry and prior experience.

Unemployment Tax Update

Unemployment taxes are due on wages paid to employees who have qualified for unemployment benefits. The amount of the taxes depends on state laws and employer policies. Most employers pay both federal and state unemployment tax. To qualify for benefits, an employee must have worked for a covered employer for 20 or more weeks in the past 52 weeks. This includes part-time and temporary workers.

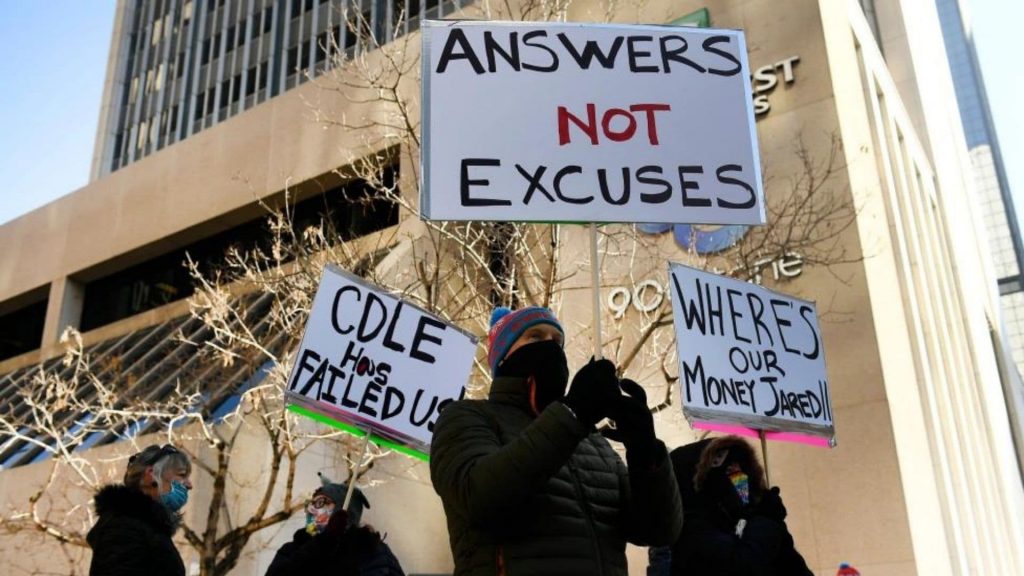

Many states saw sizable increases in their unemployment insurance (SUI) rates during the COVID-19 pandemic. However, some acted quickly to mitigate these increases. These mitigation efforts helped lower the average increase in SUI rates in 2021. The outlook for unemployment taxes in 2023 is uncertain.

In California, 2025 SUI rates will remain unchanged from the previous year. The rate for experienced employers will continue to range from 0.3% to 7.3%, with the maximum rate for new employers varying by industry. The social cost rate will also remain at 0.3%, and the reserve factor is 1.10%. The taxable wage base remains at $7,000.

For employers in Nebraska, 2025 SUI rates will not change from the current year. The rate for experienced employers will remain at 0% to 0.73% for positive-balance employers, with rates ranging from 1.5% to 5.4% for negative-balance employers. The rate for new non-construction employers will also remain at 0% to 0.65%. Rates for construction and non-construction employers with a subsidiary and reemployment service fund tax will be 2.1% to 9.9%.

New Hampshire is another state that will not change its 2025 SUI rates. The rate reduction is triggered because the state’s SUI account balance has remained above its solvency threshold for the fourth quarter. This will help offset the impact of the federal FUTA rate surcharge, scheduled to increase by 0.5% in 2023.