IRS Payments Returned Wrong Address in California: How to Fix and Prevent Delivery Issues

Ever had your IRS payment or refund bounce back because it was sent to the wrong address in California? This article unpacks why IRS payments get returned, how to fix an address mix-up, and what steps to take so your money doesn’t go on a postal adventure without you.

Contents

When it comes to IRS payments returned wrong address in California, you’re definitely not alone—especially in a state where people move as often as the seasons change. If your IRS refund check or payment was sent to an outdated or incorrect address, it can feel like your money is playing hide-and-seek somewhere in the California postal system. The IRS typically mails checks and important notices to the last address they have on file, which is usually the one from your most recently filed tax return or a notice you submitted directly to them. Unfortunately, even if you’ve set up mail forwarding with USPS, government checks usually aren’t forwarded, and undeliverable payments are sent back to the Treasury. This can lead to delays, confusion, and a lot of time spent on hold with the IRS.

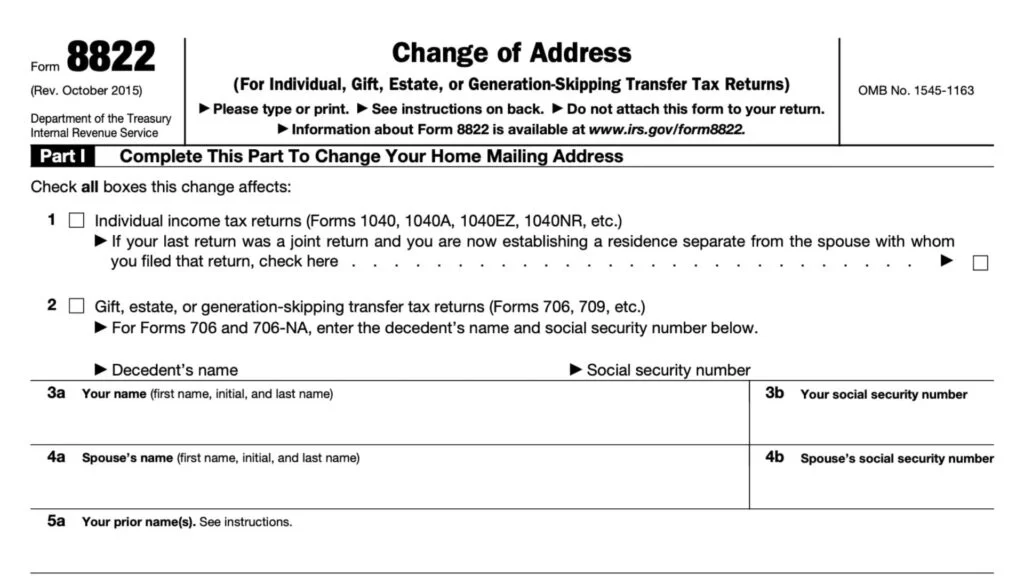

To get your payment or correspondence back on track, you’ll need to update your address with the IRS using Form 8822 (for individuals) or Form 8822-B (for businesses), or by calling their main number. Be prepared for a waiting period of four to six weeks for address changes to process, and remember: the IRS won’t automatically resend your check—you’ll need to request a payment trace and reissue. Staying proactive and double-checking your address before tax season can save you a lot of hassle, and if you’ve already hit a snag, don’t panic—there are clear steps to get your funds rerouted to your correct California address.

Why Do IRS Payments Get Returned in California?

- Address on File Is Outdated: The IRS uses the last known address from your most recently filed return or a submitted change of address form.

- USPS Mail Forwarding Doesn’t Cover Checks: Even if you’ve set up mail forwarding, government checks aren’t forwarded and get sent back as undeliverable.

- Paper Filing Confusion: Mailing tax returns or payments to the wrong IRS address (especially after the closure of some California processing centers) can cause delays.

- Processing Delays: It can take weeks for the IRS to process an address change, so checks sent during that window may still go to your old address.

What To Do If Your IRS Payment or Refund Was Sent to the Wrong Address

- Update Your Address ASAP: Use IRS Form 8822 for individuals or Form 8822-B for businesses. You can also call the IRS at 1-800-829-1040 to report the change, but expect long wait times.

- Request a Payment Trace: If your check was returned as undeliverable, ask the IRS to initiate a payment trace and reissue the refund to your new address. You’ll need to verify your identity and provide details from your last tax return.

- No Need to Amend Your Return: An incorrect address on your return doesn’t require an amended return—just notify the IRS of the correct address.

- Wait for Processing: After updating your address, it may take up to six weeks for the change to be reflected in IRS records. If you don’t receive your reissued check within four weeks, follow up with the IRS.

- Check Your IRS Transcript: Updates about your refund status often appear here before you get official mail or emails.

Pro Tips for California Taxpayers

- Double-Check IRS Mailing Addresses: Especially if you’re mailing a paper return or payment, use the latest IRS instructions for California residents—processing centers have changed in recent years.

- Certified Mail is Your Friend: Send important documents with tracking and a postmark for proof of timely mailing.

- Keep Your Info Updated Every Year: If you move, notify both the IRS and USPS, but remember that only direct notification to the IRS guarantees your address is updated for payments.

FAQs

Q: What should I do if my IRS refund check was sent to the wrong address in California?

A: Update your address with the IRS using Form 8822 and request a payment trace to have the check reissued to your correct address.

Q: How long does it take for the IRS to process an address change?

A: It typically takes four to six weeks for the IRS to process a change of address request.

Q: Will the USPS forward my IRS refund check if I move?

A: No, government checks are not forwarded by USPS—even if you have mail forwarding set up. Always notify the IRS directly.

Q: Do I need to amend my tax return if I put the wrong address?

A: No, you do not need to amend your tax return. Just notify the IRS of your new address as soon as possible.

Q: What is the IRS phone number for address and payment issues?

A: Call the IRS at 1-800-829-1040 for help with address updates and payment traces.