IRS Get Transcript for Business

The Internal Revenue Service offers various tools for taxpayers to make their life easier. As a business owner, one of the few tax tools you’re going to use often when necessary is the Get Transcript online tool.

When you’re applying for a new credit line or a mortgage for your business, lenders oftentimes require business owners to present their tax transcripts. Although a tax transcript doesn’t include detailed information compared to a copy of a tax return, it still provides enough to let the financial institutions know whether or not you’re responsible for your payments.

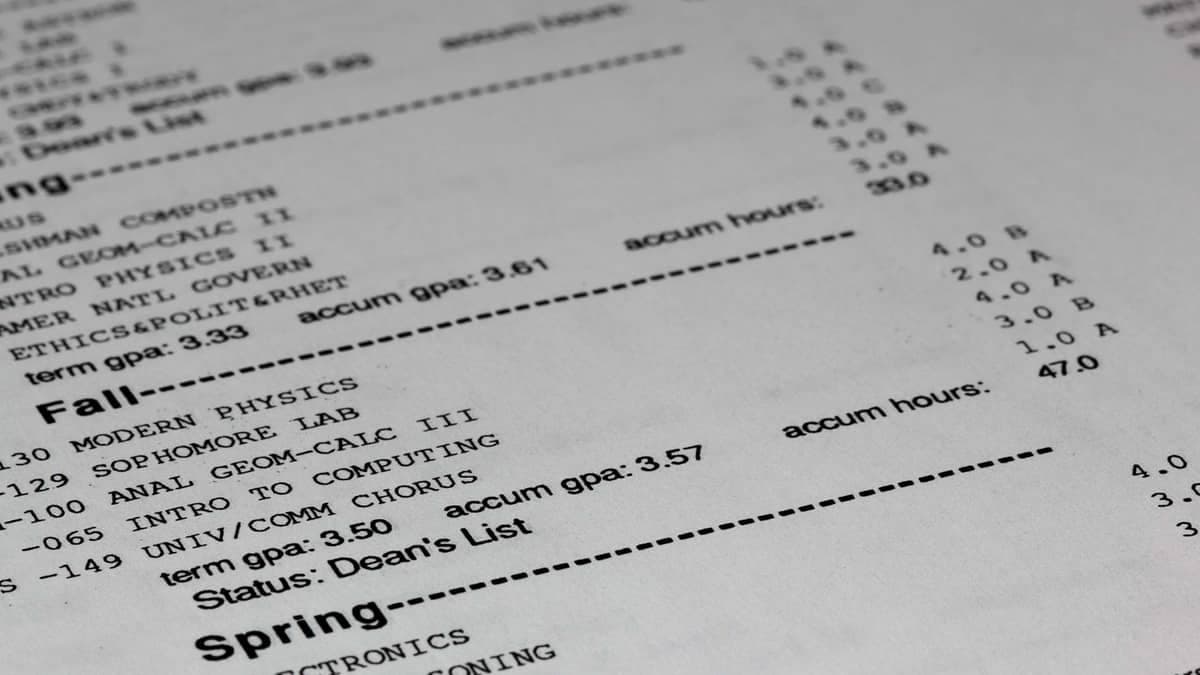

Your tax transcript will show your adjusted gross income, which is what most lenders are after as your income is a good determination point for them to see if you’re going to be able to make your payments on time. You can also notice other relevant basic information that went into your federal income tax return. The best part about tax transcripts is that you’ll be able to get them not only for the most recent tax season but previous tax seasons as well. The IRS generally generates tax transcripts for as far back as the mid-2000s.

How to generate tax transcripts online for business?

There are two ways to generate tax transcripts. You can either fill out the tax transcript request form, 4506-T or get them online. There are mostly downsides to requesting tax transcripts from the IRS by mail. It takes between two and three weeks for the IRS to comply with your request and send them copies of your tax transcripts. With generating your tax transcripts online, you won’t need to go through as much hustle and bustle, and you’ll get your transcript much faster, in about ten minutes. Since you’re going to wait for about two weeks for the transcripts to get to you, getting them online is a lot more convenient.

Use the IRS Get Transcript to generate tax transcripts online. On the IRS Get Transcript tool, you’ll be able to generate transcripts in under 10 minutes. Whether you’re looking for a tax transcript for your business or individually for yourself, you’ll be able to generate them easily.

What are tax transcripts for?

The most common reason why taxpayers request tax transcripts from the IRS is to show them to lenders when applying for a new credit line. Another common reason is to see the summary of their federal income tax returns. There is a massive spike in the number of taxpayers who request tax transcripts during the tax season. This alone explains what’s the motive behind requesting tax transcripts.

Getting your tax transcript can help you see the direction your business is headed in terms of net income. Since you’re going to pay a portion of your income in taxes regardless, knowing your net income and see how much you’re left from operations to expand the scale of your business is something very valuable. The tax transcripts are simple yet very effective documents that present you a year’s total net income.

I believe get tax transcript request for business cannot be made online on IRS website. I believe the online option is available for individual only.