Idaho W-4 Form

Colorado, Idaho, Nebraska, New Mexico, North Dakota, Oregon, South Carolina, and Wisconsin are all rolling out their own versions of the state W-4 form.

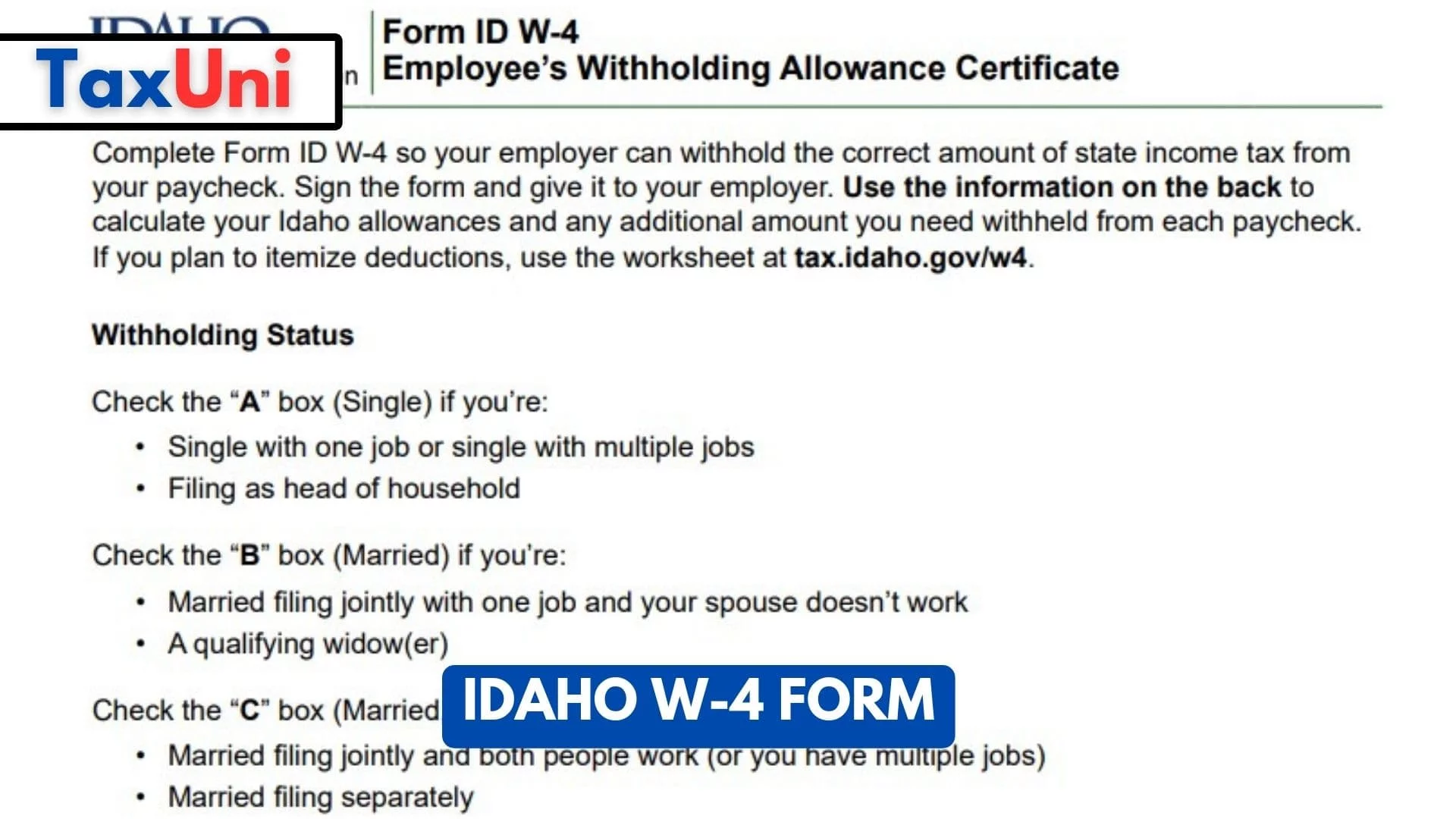

Each person who earns wages in the State of Idaho is required to pay Idaho state income tax. In order to determine how much should be withheld from each paycheck, employees must submit a W-4 Employee Withholding Allowance Certificate (Idaho W-4 Form). This form is similar to the Federal Form W4, but it also allows the employee to indicate their filing status and personal allowances.

The biggest change from previous versions of the form is the addition of a field for claiming multiple allowances. This allows for more flexibility in adjusting the amount of withholding from each paycheck. When submitting the Idaho W-4 form, it’s important to have peace of mind that the document will be legally binding and secure

Who Must File Idaha W-4 Form?

In Idaho, employees also need to fill out a state income tax withholding form, known as Form ID W-4. This form differs slightly from the federal W-4 and should be collected during new hire onboarding.

Depending on your company’s payroll schedule, you may need to file quarterly, monthly, or semiweekly payroll taxes with the state of Idaho. It’s important to pay attention to Idaho’s specific payroll regulations, such as workers’ compensation and unemployment insurance requirements.

Using a payroll service can make the process easier and less time-consuming. They can also help you avoid costly penalties by automatically filing and paying your Idaho payroll taxes. It’s a great way to simplify your payroll processes and focus on growing your business.

What is Idaho Withholding Tax?

The state’s withholding tax applies to wages, bonuses, commissions, overtime pay, severance pay, awards, prizes, back pay, retroactive payments, expense allowances paid under a nonaccountable plan, and other similar supplemental wages. In addition to the state’s withholding tax, employers must also withhold Social Security and Medicare taxes.

Idaho’s state unemployment insurance (SUI) is funded by employee payroll deductions. Generally, workers must be employed for 20 weeks before they can claim unemployment benefits. If an employee quits or is terminated, the employer must pay them their final paycheck within 10 days of the date they leave. This includes accrued vacation time