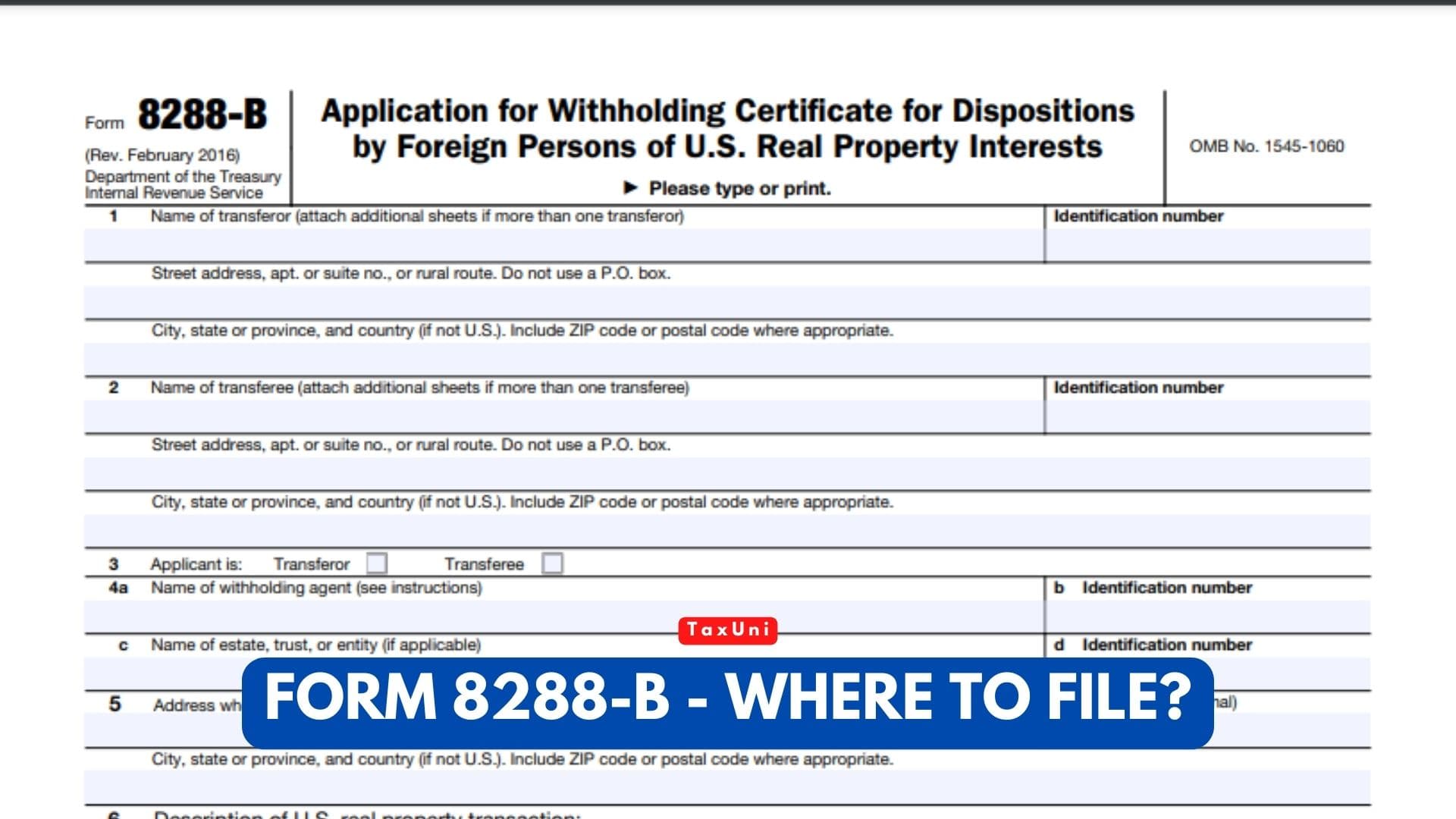

Form 8288-B – Where to File?

Whether you are going to apply for the exemption, a reduction of the withholding amount, or withhold certification, you need to file your form with the IRS. However, one important issue you need to pay attention to while filing Form 8288-B is the timing. Both buyers and sellers must pay attention to the filing requirements for the flawless processing time of your request.

It is important to keep up with schemes determined by the IRS, and the IRS considers the date of the transfer as the date on which the consideration is paid by the buyer but not the contract date. This means that you need to take action based on the closing when the transfer occurs.

If both buyers and sellers have timing issues with their filings, they may have to deal with some major problems. One of these is the rejection of Form 8288-B by the seller. In addition, buyers may have to pay penalties and interest since they will fail to remit the required withholding tax within 20 days after the transfer.

We recommend working with a tax professional if you are unsure about what to do, how to fill out the form, or when to file it. This can be highly beneficial if it is the first property you are going to sell as a foreigner in the United States. Besides helping you to save time, this will protect the buyer and seller from additional liabilities and avoid additional costs such as interest and penalties.

Don’t Forget To Sign and Make Sure You Wrote The Date Correctly.

Some of the common mistakes made while filing Form 8288-B include failing to provide a reason for the request for reduced withholding. Moreover, believe it or not, not signing or typing the date is one of the most common mistakes that most buyers and sellers make.

You also need to provide the address and use of the property in question. The addresses must be provided accurately and separately. Moreover, you also need to accurately identify the names of both parties as well as any withholding agent who will carry out the operations on your behalf.

One of the other common mistakes that most filers make is not properly calculating the withholding or providing the required documents as proof. Some of these documents include depreciation schedules, improvements, and purchase prices.

Form 8288-B is one of the more challenging forms to fill out and file. Therefore, getting professional help will be in your favor, especially when we consider the long processing times of the IRS these days.