Energy-Efficient Tax Credits: A Guide to U.S. Tax Incentives for Green Home Improvements

Contents

As we become more conscious of the environmental impacts of our everyday actions, many homeowners are looking for ways to make their homes more energy-efficient. In response to this growing trend, the U.S. government has implemented a variety of tax incentives to encourage green home improvements. This article will explore the available tax credits for energy-efficient upgrades, providing a comprehensive guide to help homeowners navigate these incentives.

1. Understanding Energy-Efficient Tax Credits

Energy-efficient tax credits are designed to reduce the financial burden on homeowners who invest in green home improvements. These credits are typically available for specific energy-saving measures, such as installing insulation, upgrading windows and doors, or investing in renewable energy systems like solar panels.

Key Takeaways:

- Tax credits directly reduce your tax liability.

- Energy-efficient tax credits encourage homeowners to invest in eco-friendly home improvements.

- There are several federal, state, and local tax incentives available.

2. Residential Energy Efficiency Tax Credit (REEP)

The Residential Energy Efficiency Tax Credit (REEP) is a federal tax credit available to homeowners who make qualified energy-saving improvements to their primary residence. This credit covers a percentage of the cost of certain energy-efficient upgrades up to a specified maximum amount.

Eligible Improvements:

- Insulation materials and systems

- Exterior windows, skylights, and doors

- Certain roofing products

- High-efficiency heating and cooling systems

- Water heaters

Key Takeaways:

- The REEP tax credit is available for primary residences only.

- The credit covers a percentage of the cost up to a specified maximum amount.

- Homeowners must make eligible improvements to qualify for the credit.

3. Renewable Energy Tax Credits

Renewable energy tax credits offer incentives for homeowners who invest in renewable energy systems for their homes. The most common systems include solar panels, solar water heaters, small wind turbines, and geothermal heat pumps.

Key Takeaways:

- Renewable energy tax credits can offset the cost of installing renewable energy systems.

- The credit is available for both primary residences and secondary homes.

- Some credits may be carried forward if the homeowner’s tax liability is not large enough to use the entire credit in one year.

4. Energy-Efficient Home Construction Tax Credit

This tax credit is available for contractors who build energy-efficient homes, including new homes and substantial reconstruction projects. To qualify, the home must meet specific energy-efficiency standards and be certified by a qualified energy rater.

Key Takeaways:

- The credit is intended for contractors but can indirectly benefit homeowners by lowering construction costs.

- Eligible homes must meet specific energy-efficiency standards.

- The credit is only available for new home construction or substantial reconstruction projects.

5. State and Local Incentives

In addition to federal tax credits, many states and local governments also offer incentives for energy-efficient home improvements. These incentives can include additional tax credits, rebates, grants, and low-interest loans. Homeowners should check with their state and local governments to determine the availability of these incentives in their area.

Key Takeaways:

- State and local incentives can further reduce the cost of energy-efficient upgrades.

- Incentives vary by location and may include tax credits, rebates, grants, and low-interest loans.

- Homeowners should research their local programs to maximize savings.

6. How to Claim Your Energy-Efficient Tax Credits

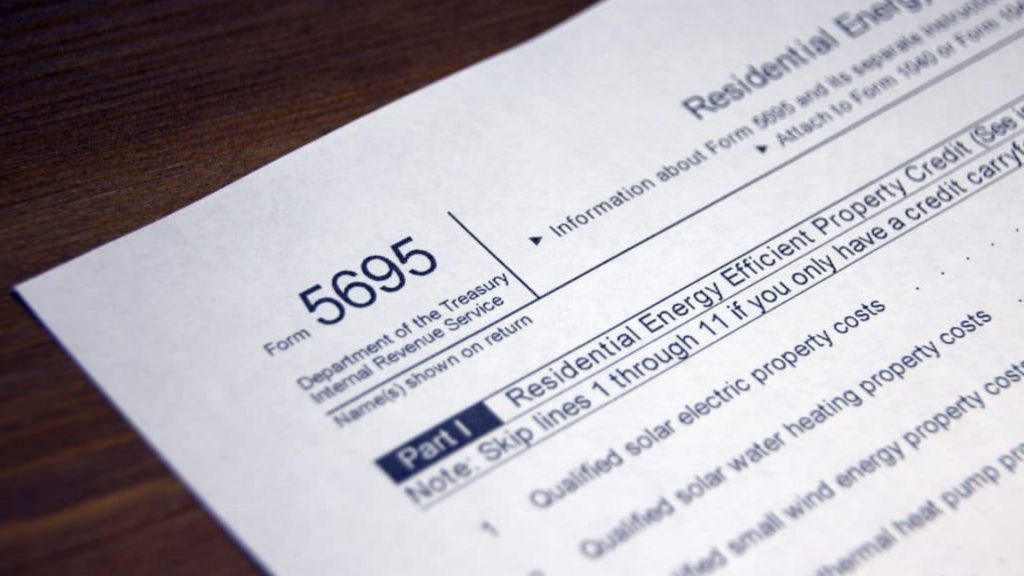

To claim energy-efficient tax credits, homeowners must complete the appropriate forms and submit them with their federal tax returns. For the REEP and renewable energy tax credits, homeowners should complete IRS Form 5695, Residential Energy Credits. Energy-efficient home construction tax credits require contractors to complete IRS Form 8908, Energy Efficient Home Credit.

Key Takeaways:

- Homeowners must complete the appropriate IRS forms to claim energy-efficient tax credits.

- The forms should be submitted with the homeowner’s federal tax return.

- The required forms may vary depending on the specific tax credit being claimed.

Can I claim energy-efficient tax credits for improvements made in 2024?

Yes, energy-efficient tax credits are available for qualified improvements made in 2024. Be sure to check the specific requirements for each tax credit, as some incentives may have changed or expired since 2023.

Can I claim these tax credits if I rent my home?

Generally, energy-efficient tax credits are available only to homeowners. However, landlords may be eligible for certain credits or incentives if they make energy-efficient improvements to rental properties. It is essential to check the specific requirements for each tax credit or incentive program.

Can I claim multiple energy-efficient tax credits?

Yes, homeowners can claim multiple energy-efficient tax credits as long as they meet the requirements for each credit. However, some credits may have a combined maximum limit, so it’s essential to understand the rules and limitations for each incentive program.

Energy-efficient tax credits are an excellent way for homeowners to offset the costs of green home improvements and reduce their environmental impact. By understanding the available incentives and taking advantage of federal, state, and local programs, homeowners can make their homes more energy-efficient and save money on their taxes. As a homeowner, it’s essential to research the specific requirements for each tax credit and consult with a tax professional to ensure that you can maximize the benefits of these incentives.

Overview of Energy-Efficient Tax Credits and Incentives

| Tax Credit/Incentive | Description | Eligible Improvements/Systems | Credit Amount/Percentage | Primary Residence Only? | Carryover Allowed? |

|---|---|---|---|---|---|

| Residential Energy Efficiency (REEP) | Federal tax credit for energy-saving improvements to primary residences. | Insulation, windows, doors, roofing, heating/cooling systems, water heaters. | Percentage of cost up to a maximum amount | Yes | No |

| Renewable Energy | Federal tax credit for investment in renewable energy systems. | Solar panels, solar water heaters, small wind turbines, and geothermal heat pumps. | Percentage of cost | No | Yes |

| Energy-Efficient Home Construction | Federal tax credit for contractors building energy-efficient homes. | New homes or substantial reconstruction meeting energy-efficiency standards. | Flat credit amount per eligible home | N/A (for contractors) | No |

| State and Local Incentives | State and local incentives, which may include tax credits, rebates, grants, and low-interest loans. Incentives vary by location. | Varies by program and location. | Varies by program and location. | Varies by program | Varies by program |