Business Tax Extension – 7004 Form

Contents

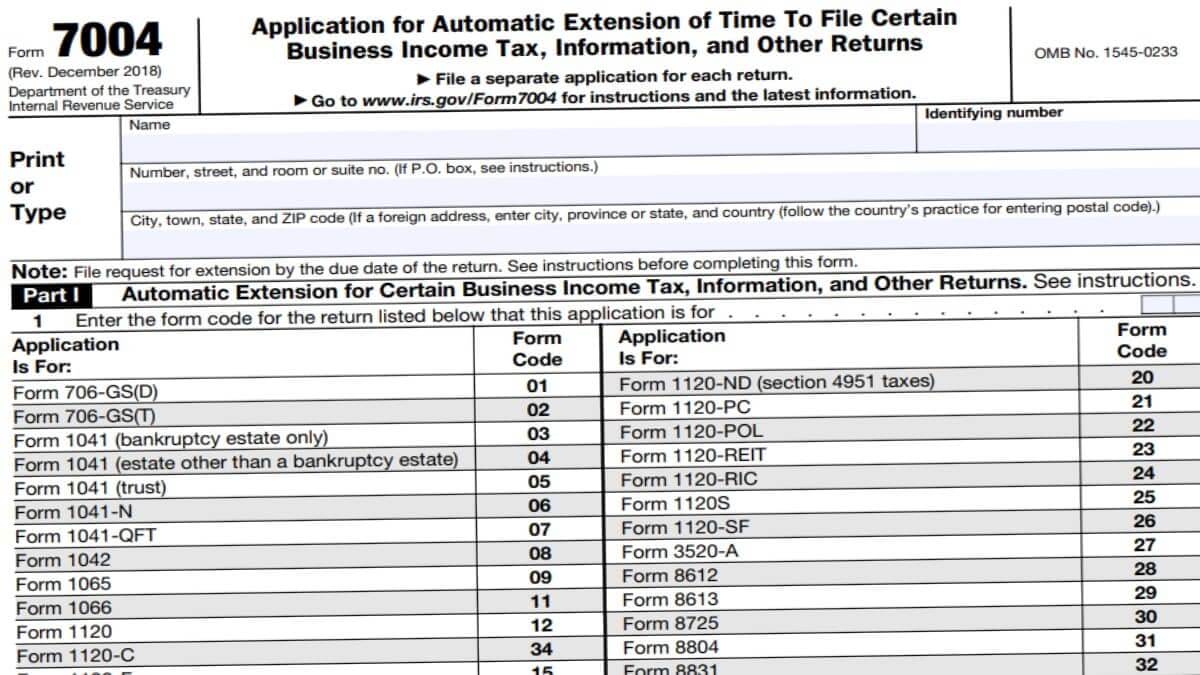

Form 7004—Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns is for business tax extension.

Fill out Form 7004 to apply for a business tax extension to request six more months from the IRS to file a certain income, information, and other returns.

Form 7004 is a single-page IRS tax form that is simple enough to file in minutes. When filing it, you will need to enter what forms you’re filing an extension for.

Instructions to File Form 7004

On Form 7004, you will need to enter the corresponding form code in Part 1. With this form, you can file an extension for the following income, information, and other returns.

Forms 1041 (choose the right form code), 1041-N, 1041-QFT

Forms 1120, 1120-C, 1120-F, 1120-FSC, 1120-H, 1120-L, 1120-ND, 1120-PC, 1120-POL, 1120-REIT, 1120-RIC, 1120S, 1120-SF, 3520-A

Form 8725

Form 8804

Form 8831

Form 8876

Form 8924

Form 8928

On Part 2 of Form 7004, you need to provide certain things about your organization such as whether or not it’s a foreign business, Fiscal Year of the business, and other related information if your tax year is less than 12 months.

E-Filing Requirements

As far as the instructions to file, these should be your concern. As for filing Form 7004, you can either file it online for mailing it to the IRS or e-file. However, you can only file Form 7004 if none of the following applies to you.

- Applications attaching Form 2848. The Power of Attorneyshould be sent separately and not with 7004.

- Applications requesting extension due to change in accounting period unless prior approval has been applied for from IRS or certain conditions have been met.

- Applications with Net Operating Loss Carryback.

- Early filed returns

- Election to make installment payments for a portion of balance due amount.

- Filing short period extension due to termination of 1120S status

- Name change applications

- Reasonable cause for failing to file application timely

- Reasonable cause for failing to pay timely

- Requests for refunds

- Extensions for the following forms.

- Form 706-GS(D)

- Form 8612

- Form 8613

- Form 8725

- Form 8831

- Form 8876

As long as none of the above applies to you, go ahead and file Form 7004 with an IRS authorized e-file provider.

Online Filing Form 7004 (Fillable Printable PDF)

Start filing Form 7004 online. Click the corresponding boxes that you need to enter your information and get it done within minutes.

After you’re done filling out, use the print or download button inside the PDF file. Do not use the separate download button as it will download the blank version of Form 7004. You can also download the IRS PDF file that includes the due dates of Form 7004 for each income, information, and other return you’re filing it.

Form 7004 Mailing Addresses

| Form | State of Residence or Principal Place of Business | Mailing Address |

|---|---|---|

| 1041 1120-H | Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, and Wisconsin | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0019 |

| 1041 1120-H | Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, and Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0045 |

| 1041 1120-H | Foreign Country or U.S. possession | Internal Revenue Service P.O. Box 409101 Ogden, UT 84409 |

| 1041-QFT 8725 8831 8876 8924 8928 | Any Location | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0019 |

| 1042 1120-F 1120-FSC 3520-A 8804 | Any Location | Internal Revenue Service P.O. Box 409101 Ogden, UT 84409 |

| 1066 1120-C 1120-PC | Any Location Within the U.S. | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0045 |

| 1066 1120-C 1120-PC | Foreign Country or U.S. Possession | Internal Revenue Service P.O. Box 409101 Ogden, UT 84409 |

| 1041-N 1120-POL 1120-L 1120-ND 1120-SF | Any Location | Department of the Treasury Internal Revenue Service Ogden, UT 84409-0045 |

| 1065 1120 1120-REIT 1120-RIC 1120-S 8612 8613 | Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, and Wisconsin | And the total assets at the end of the tax year are: Less than $10 million: Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0019; $10 million or more: Department of the Treasury Internal Revenue Service Ogden, UT 84201-0045 |

| 1065 1120 1120-REIT 1120-RIC 1120-S 8612 8613 | Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, and Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0045 |