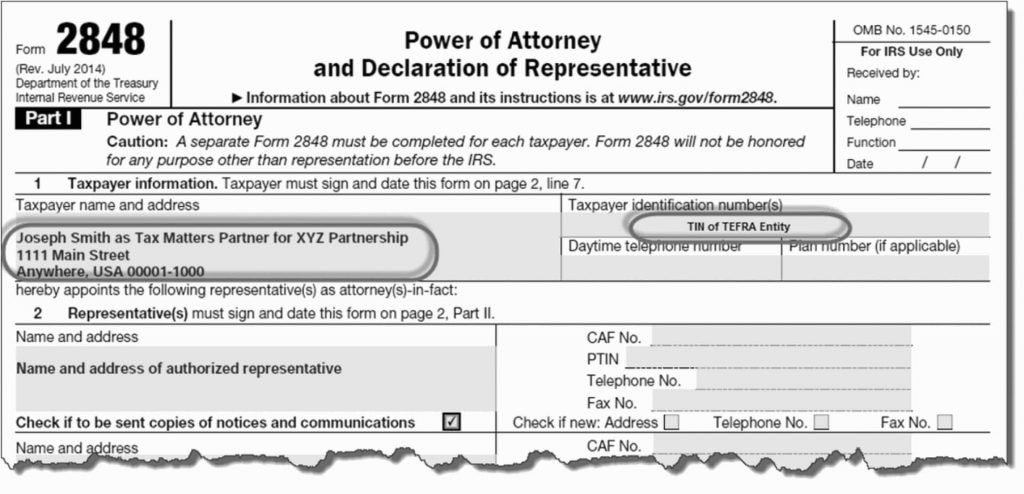

IRS Form 2848 – Power of Attorney

Contents

If you have ever had any legal application or situation where you need someone to represent you, then you might have already heard the term “power of attorney” before. Basically, “power of attorney” allows someone to represent you legally and make financial or medical decisions on your behalf. Depending on the context, you can give them a wide range of permissions to act on your behalf.

If you would like to do the same for the IRS, you need to use Form 2848, which is the “Power of Attorney and Declaration of Representative.” This form allows someone to be appointed on your behalf to handle all kinds of IRS processes for you. Although these are not limited to the following, some of the actions may include,

- Accessing your IRS account and the transcripts in it

- Responding to notifications of warnings on your behalf

- Requesting copies of IRS notices

- Signing on your behalf,

- Negotiating your payment plan

- Appealing disputes with the IRS

When Should You File Form 2848?

Of course, as you might guess, you can’t grant “power of attorney” to everyone. Most of the time, you use IRS Form 2848 to authorize tax professionals so that they can handle all the operations on your behalf with the IRS.

On the other hand, you can also authorize your immediate family members, but no one else can be granted “power of attorney.” Here are the professionals and people you can grant “power of attorney” with Form 2848:

- Representatives working in qualified Student Tax Clinic Programs or Low-Income Taxpayer Clinics,

- Qualified enrolled retirement plan agents. You can grant them power of attorney only for retirement plan taxation.

- Full-time employees or corporate officers of your organization or business, but you can grant them power of attorney only for business taxation

- Return preparers, but you can grant them power of attorney only for tax return processes.

- Enrolled actuaries

- Enrolled agents

- Attorneys

- CPAs

Why Might You Need to Appoint an IRS Power of Attorney?

Below, we have shared some reasons and cases where you might need to appoint an IRS power of attorney on your behalf. These and similar cases are good reasons to appoint a power of attorney:

You can consider appointing “power of attorney” to your attorneys so that they can negotiate your payment arrangements when you have any unresolved tax debt.

If you have any medical condition that prevents or makes it difficult for you to carry out your IRS operations, you can grant “power of attorney” to any of your immediate family members to handle all these processes on your behalf.

Sometimes, taxpayers may be audited by the IRS, and if you grant “power of attorney” to a CPA, you can let them directly work with the auditor.

There are many other cases and scenarios in which you may want to grant a “power of attorney” to a professional. However, it is worth noting that you can file IRS Form 2848 just to save time, or let a professional handle all your operations. Unless you grant “power of attorney” to a qualified individual confirmed by the IRS, the reason for your grant is not important at all.

Where Should You File Form 2848?

Once you complete IRS Form 2848, you and your representative must sign the form. If you are married, your spouse also needs to sign the form you filled out as well. Once you are done, you can file your form with the IRS.

If you are going to work with tax professionals, they will provide you with a mail address from which you can send the form. The phone number and mail will vary depending on what state you are living in. However, if you are not working with a tax professional, you can always access this information by visiting the official website of the IRS.

It is worth noting that the IRS Form 2848 you are going to file will grant “power of attorney” to your representative for seven years. For some reason, if you would like to cancel this grant, you need to file a new form with another representative or write “REVOKE” on the first page of the form. Of course, you need to sign and write the date of the revoke before you send it to the IRS again.