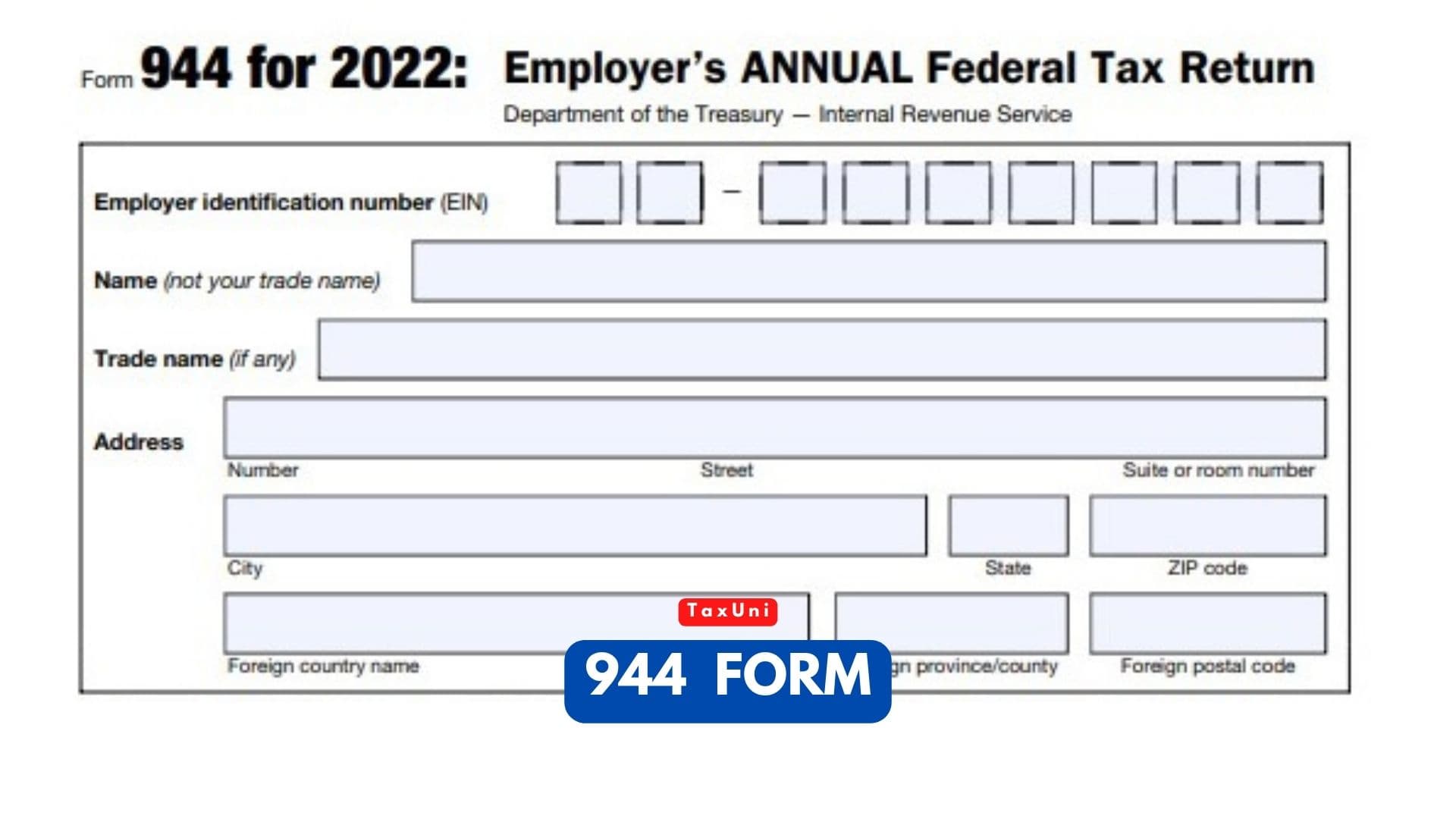

944 Form

Form 944 is an IRS tax form allowing small employers to report and pay federal payroll taxes yearly instead of quarterly. Read on for an overview of Form 944 and instructions for it.

944 Form, Employer’s Annual Federal Tax Return, was introduced by the IRS to help small businesses reduce their tax liability. Form 944 is a form that small business owners can use to report their annual employment taxes. It’s meant for employers whose payroll tax liability is less than $1,000 annually. It’s the alternative to Form 941 (Employer’s Quarterly Federal Tax Return).

The IRS requires you to report the amount of federal income taxes, state taxes, and FICA taxes withheld from employee wages on Form 944. It also asks for information regarding the additional Medicare tax withheld from employees earning more than a certain set income.

Aside from these taxes, you must also report any federal and state unemployment insurance benefits you pay employees on this form. If you’re unsure if you have to report these taxes, talk to a tax adviser or CPA before you start filling out this form.

Form 944 Instructions

If you own or manage a small business, you may be required to file 944 Form. The IRS will notify you in writing if this is the case, and it’s important to follow their instructions closely when filing this tax form.

- Part 1 of Form 944 requires you to provide all your employees’ wages, tips, and other compensation totals. These figures should be available from your accounting or payroll records. Moreover, you need to ensure that the taxes you withheld from your employees’ pay were deposited. This can be done by checking the correct boxes in the appropriate sections.

- In Part 2, you’ll enter details about your business’s deposit schedule and tax liability for the year. You owe less than $2,500, so check the box and move to Part 3. If it’s more, you must indicate this in line 9.

- You can also complete Part 3 of 944 Form, which includes questions about special treatment for qualified health plan expenses, sick leave wages, and employee retention credits. You can leave these boxes blank or include a statement about them.

- The last section of Form 944 is Part 4, which asks if you grant the IRS permission to speak with a third-party designee on your behalf. This could be a person like an employee, tax preparer, or CPA.

Difference between Form 941 and Form 944?

Form 941 is a quarterly Federal Unemployment Tax Act (FUTA) return that employers use to report and pay benefits to workers who have worked enough hours during a calendar quarter. In addition, Form 941 is used to report and remit the taxes that you withhold from employee wages. Businesses with employees are required to file Form 941 every quarter, regardless of their business entity (sole proprietor, C corporation, etc.). These reports are important because they help you keep track of the income and expenses you generate in your business, as well as the taxes you withhold from each paycheck.

However, some smaller employers have been able to avoid the quarterly filing requirements by electing to file 944 Form instead. The IRS requires written consent from the employer for this to occur. This form is for small businesses with annual employment tax liability of less than $1,000. It is available only to those who have received a notice of their eligibility to file this form. The IRS also requires that businesses that have been notified to use 944 Form deposit payroll taxes on a semiweekly basis with the IRS EFTPS system. They must deposit their taxes collected during the previous month by the 15th day of the following month.

You will need to complete Schedule B and attach it to your Form 941 to determine your tax deposit schedule. For this, you will need to enter your total daily payroll tax liabilities and the corresponding tax liability for each month in your lookback period. You will also need to include any overpayment you applied from a previous period and any additional Social Security and Medicare tax adjustments made during the year.