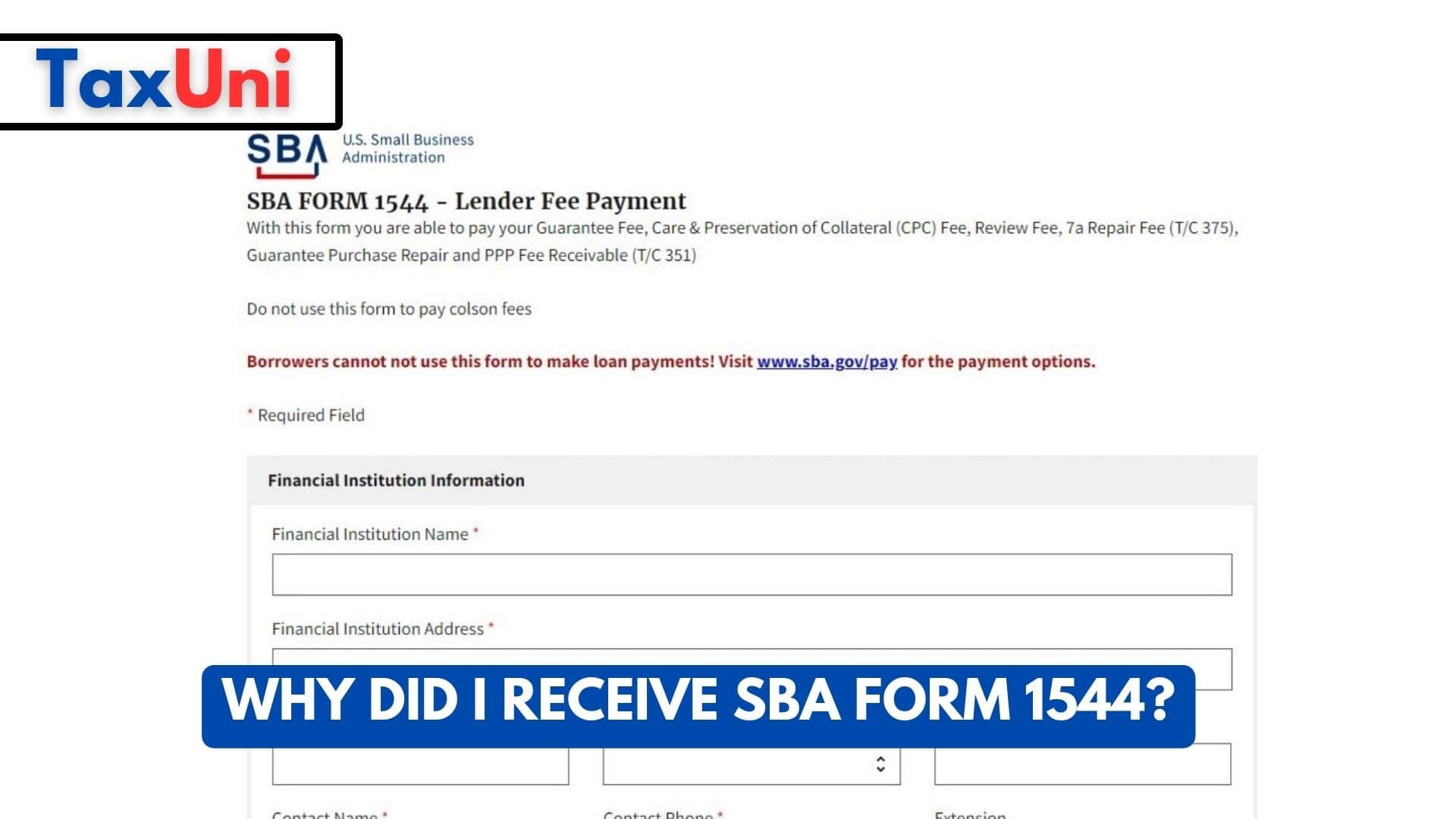

Why Did I Receive SBA Form 1544?

If you are applying for an SBA loan, you may be required to complete SBA Form 1544. It requires a comprehensive summary of your professional experience, education, affiliations, and associations and answers to a series of legal and compliance questions.

If you are a lender that has paid fees to the SBA on behalf of a 7(a) or 504 loan borrower, you may need to submit SBA Form 1544. This form is required to verify that all of the information on the application or other documentation you or your client provided is accurate and complete. It also includes questions that ask about any legal or compliance issues that may be of concern to the SBA. It must be completed by all owners, partners, shareholders, officers, and directors who own a significant interest in a for-profit business that is applying for an SBA loan.

The Small Business Administration (SBA) is an independent agency of the U.S. federal government established to aid, counsel, assist, and protect the interests of small business concerns, and to maintain and strengthen the nation’s overall economy. The SBA has a number of programs to provide financing for small businesses, including loans and venture capital.

Lenders must also send copies of all attorney’s fees for each SBA guaranty purchase to the SBA. These fees will be reviewed for necessity, reasonableness, and whether or not they are customary for the area. If any of the attorney’s fees are deemed unnecessary, unreasonable, or not customary, they will be deducted from the final recovery amount. The lender will then be required to reimburse the SBA for those expenses.

Why Would the SBA Send Me a Letter?

Defaulting on an SBA loan can lead to severe consequences. For example, the government can take legal action to recover what it is owed. This typically involves garnishing the debtor’s income, tax refunds, and Social Security benefits.

If you receive a demand letter from the SBA, you should contact your lender immediately to resolve the issue. You can also consider submitting an offer in compromise (OIC). This is a process where you agree to settle your debt for less than what you actually owe.

SBA is currently facing scrutiny over the PPP and EIDL program due to reports of fraud. If you receive a letter from the SBA regarding a COVID-19 PPP or EIDL loan you never applied for, report it immediately to the Office of Disaster Assistance. This will help prevent further harm to your credit and other financial assets. Moreover, you should also check your personal and business credit reports for any suspicious activity.