W4P Form

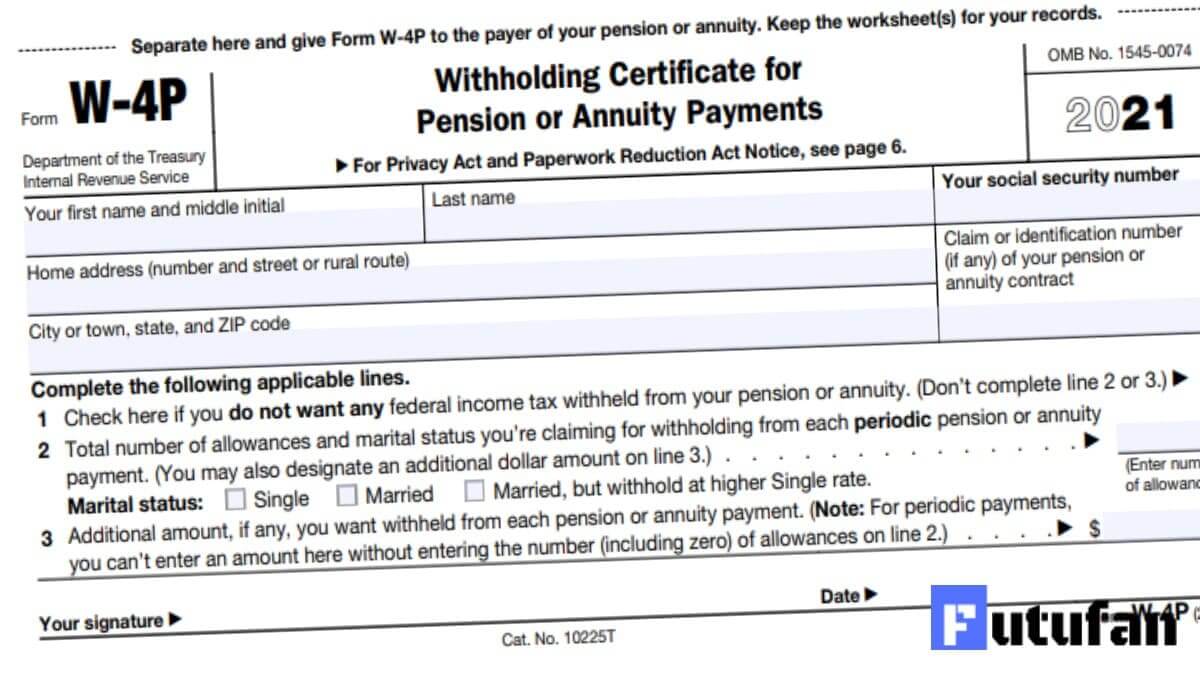

Form W-4P – Withholding Certificate for Pension or Annuity Payments is a simple tax form, similar to Form W-4 – Employee's Withholding Certificate.

Contents

Form W-4P 2025 is out and you can fill out one to let the payer know how much federal income tax needs to be withheld.

How to Complete a W4P Form

Suppose you’re an NHRS retiree or benefit recipient. In that case, you should complete a W4P Form so that your pension or annuity payer can withhold the correct amount of federal income tax from your periodic pension, annuity (including commercial annuities), profit-sharing and stock bonus plan, and individual retirement arrangement (IRA) payments.

At the end of 2025, the IRS released new federal tax withholding election forms for periodic pension and annuity payments and a new form for nonperiodic payments and eligible rollover distributions. These changes require pension plan sponsors and vendors to implement updated forms by January 1, 2025.

Form Filler Software

Form W4P is a must for anyone receiving an annuity, pension, or stock bonus plan. The form is a complex beast to navigate, especially if you’re away from the know. The best way to complete the form is to use a reputable online provider. Please sign up for a free account as soon as possible. We’re confident that you’ll be pleased with the results. Alternatively, you can opt for an old-fashioned ink and paper approach. This may be the most cost-effective route. Luckily, the form can be accessed from anywhere worldwide as long as you have an Internet connection. To get started, you need to choose a file type. Next, pick the most suitable location (on your desktop or a cloud server). Finally, you’ll need to select the most appropriate size. Then it’s time to click the submit button.

PDF Editors

A PDF editor is a software program that allows users to edit, convert, and share files in PDF format. These programs are popular among business professionals, students, and researchers.

Compression: Large files can take up a lot of space, which is why many PDF editors include compression tools that can shrink a document to a more manageable size. This feature helps save physical or cloud storage space and share documents with others.

Form-Filling Capabilities: With the rise in bring-your-own-device (BYOD) policies, employees need to be able to fill out forms on the go. A good PDF editor can help users complete forms online and quickly make changes to existing structures, allowing for more accessible data collection.

Collaboration: Modern organizations rely on remote and hybrid working, so finding a PDF editor that allows multiple people to work on a single document in real time is essential. The best PDF editors will have comprehensive share options, annotations, and commenting features.

Form Fillers for Mac

Creating and filling out PDF forms has become a must-have tool today. This is because they help reduce paper waste and save money from printing, scanning, and faxing forms.

A good PDF form filler for Mac should help you get the job done quickly and easily. Moreover, it should be feature-rich enough to customize your forms and add different annotations, such as text boxes with formatting, shapes, stamps, and stickers.

PDFelement Pro is a good choice for Mac users looking to edit and create forms and convert their scanned documents into editable formats. The program is affordable, easy to use, and comes with OCR technology that helps turn scanned files into an editable format.

The program is compatible with all major platforms, including Windows and Mac. It also has a free trial and a 30-day money-back guarantee. If you like it, subscription plans start at $9.99 per month.

Form Fillers for Windows

Form fillers for Windows are software programs that help you pre-fill forms with your saved details. This is useful for administrative tasks, such as filling out tax forms, shopping online, or entering information on a resume.

There are many form fillers for Windows, ranging from simple tools that only allow you to enter data into a form to more comprehensive software that can do everything from creating documents to editing text and performing OCR.

The best form filler for Windows is a simple application that helps you fill out a single page of a paper or electronic form without installing additional programs on your computer. The program is elementary and can be used for both work and home, so it’s an excellent option for those who want to save time on filling out forms.

Another program that can be used to fill out forms is a free PDF editor. The application is easy to use and only takes up a little space on your computer. You can also use it to edit, sign, and perform OCR on PDF files.

The purpose of Form W-4P is to provide the payer with information for accurate federal income tax withholding. If you participate in pensions, annuities, and other deferred compensation, Form W-4P will provide the payer with what needs to be known for accurate federal income tax withholding.

Having that said, if you earn income through pensions or any other form of payment as stated above, fill out Form W-4P to provide the payer with the necessary information so that tax withheld from your income isn’t too much or little.

Fill out Form W-4P below and print out a paper copy or download it as a PDF and fill out on your computer and save it.

You aren’t required to send or mail Form W-4P to the Internal Revenue Service. You will simply fill out Form W-4P and hand it to the payer.

How many allowances to claim on Form W-4P?

Unlike 2023 Form W-4 which was updated last year where allowances were removed, Form W-4P still has allowances where you need to claim to adjust taxes withheld.

To figure out how many allowances to claim on Form W-4P, use the personal allowances worksheet. This should help you with that. As a general rule, most taxpayers claim “0” if they’re single or “1” if filing a joint return, and an additional allowance for each dependent.

How to claim exemption on Form W-4P?

To be tax-exempt from withholding, enter your personal information as is and leave lines 5 and 6 blank. On Line 7 of 2025 Form W-4P, enter “Exempt”. This is how you claim an exemption from tax withholding.