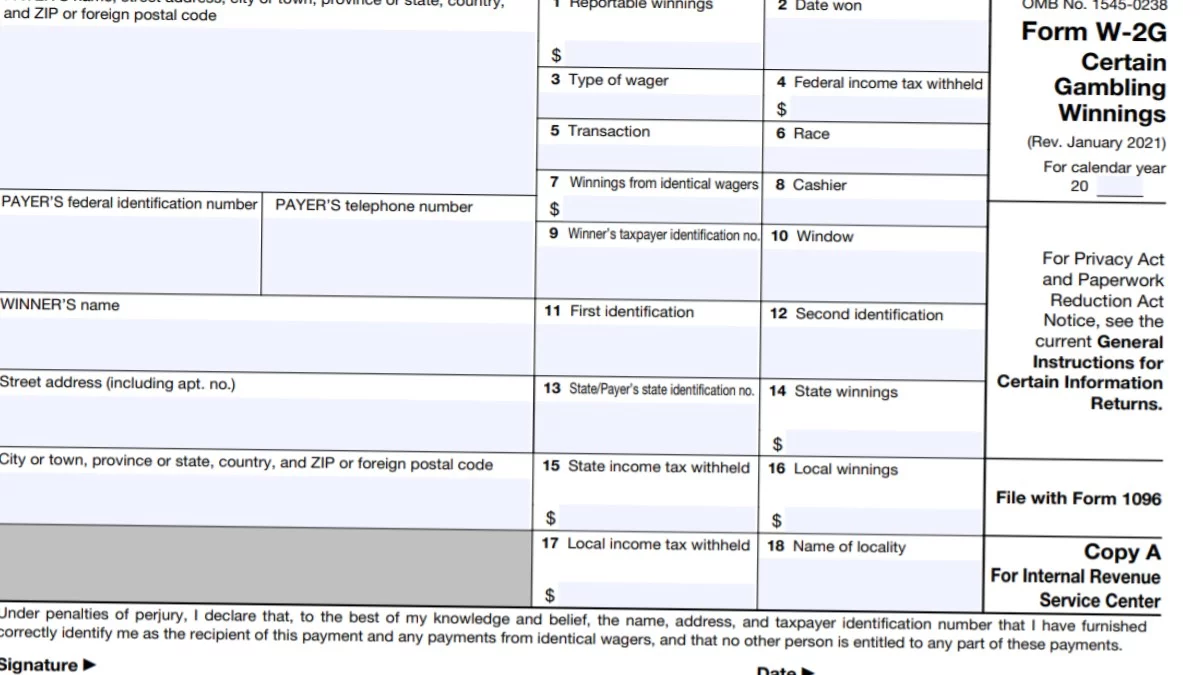

W-2G Form

Form W-2G tax form is the information return for reporting gambling income. You must file a copy and attach it to your federal income tax return. On Form W-2G, you can report the following that has a dedicated box for each.

- Reportable winnings

- Date won

- Type of wager

- Federal income tax withheld

- Transaction

- Race

- Winnings from identical wagers

- Cashier

- Winner’s TIN (SSN or ITIN)

- Window

- First identification

- Second identification

- Payer’s state identification number

- State winnings

- State income tax withheld

- Local winnings

- Local income tax withheld

- Name of locality

As you can see from the above, W-2G reports a wide variety of income, income types, and the source of income, along with income tax withheld. Make sure not to skip any of these, as it will result in you amending the tax return you originally filed with the W-2G.

Form W-2G PDF

How to attach Form W-2G?

Form W-2G, Certain Gambling Winnings, is attached to the federal income tax return of the taxpayer that files it by either stapling it to the top right or left corner of 1040 or attached electronically. As with any other information return, if it’s filed electronically, you won’t need to manually do anything as tax preparation services handle tax return attachments automatically.

Form W-2G Deadline to File

The deadline to file Form W-2G is the same as the rest of Forms W-2. You must file Form W-2G and issue a copy to the winner by January 31. Otherwise, the winner won’t be able to report the gambling winnings and the gambling issuer will be subject to late-filing penalties that can add up to a significant amount per violation.