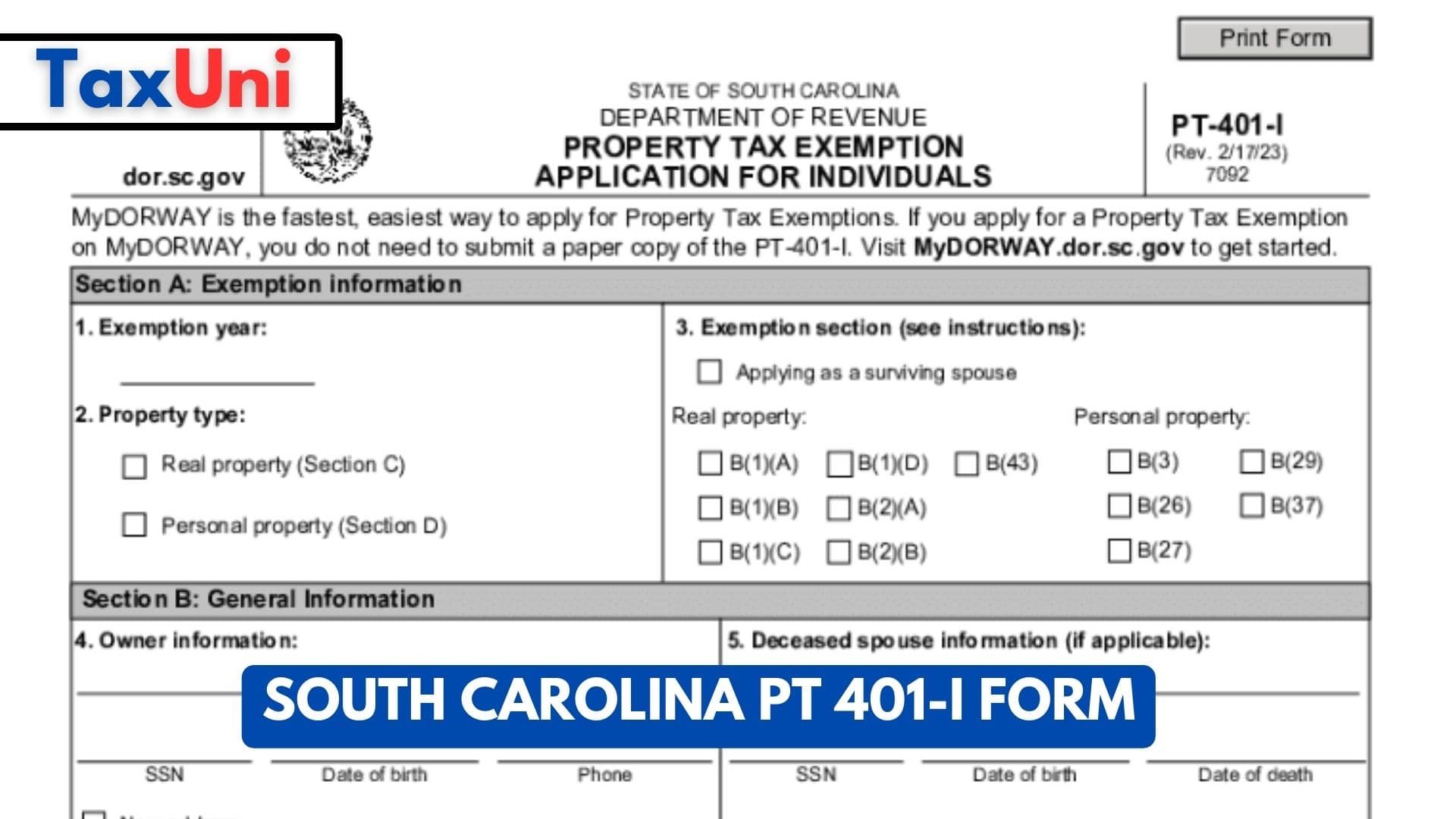

South Carolina PT 401-I Form

As the world ditches traditional office work, more and more paperwork is executed online, and the South Carolina PT 401-I Form is no exception. Working with it utilizing digital tools is legal and secure.

In order to file for property tax exemption in the state of South Carolina, individuals must complete PT 401-I. This form includes important details about the individual’s property, such as type, value, and description. In order to fill out the form correctly, it is important that individuals follow the instructions provided by the Department of Revenue. Failure to do so can lead to delays and complications.

Applicants must apply for the exemption with the Department of Veteran Affairs and provide a letter stating that they are 100% permanently disabled. They must then submit a completed PT 401-I form to the Auditor’s office. Applicants who are legally blind must also provide a letter from a doctor. In addition, a former law enforcement officer or firefighter must provide a copy of their permanent disability rating from the Workers’ Compensation Commission.

Who is Eligible for South Carolina Property Tax Exemption?

Eligible applicants for this tax exemption include:

- Veterans.

- Former law enforcement officers.

- Former firefighters who have a permanent and total service-connected disability.

- Applicants can apply for the property tax exemption on their home, automobile, or other personal property by providing proof of disability and completing PT-401-I at SCDOR.

- Unmarried surviving spouses of such applicants may also apply for the exemption.

When completing the form, concentrate on the yellowish fields as they require specific data to be placed. Also, always read the recommendations before finishing the template. Once completed, save, download, or export the file.

How to Complete the South Carolina PT 401-I Form?

- Personal Information: Provide your legal name, address, social security number, or federal identification number.

- Exemption Year(s): Indicate the year(s) for which you’re applying for the exemption.

- Real Estate Acquisition Date: If claiming an exemption for real property, mention the date you acquired the property.

- SC Code Section: List the relevant South Carolina Code Section that applies to your exemption reason (refer to the form or department website for a list of qualifying sections).

- County Information: Specify the county where the property is located.

- Property Location: If the property has a different address than your mailing address, mention the location here.

- Tax Map Number: You can find this number by contacting your county assessor’s office.

- Real Estate Exemption Details: Check the applicable box(es) that correspond to your exemption reason (e.g., disability exemption, veteran exemption).

- Deed Information: If claiming an exemption for real property, provide the deed book and page number (obtainable from your county assessor).