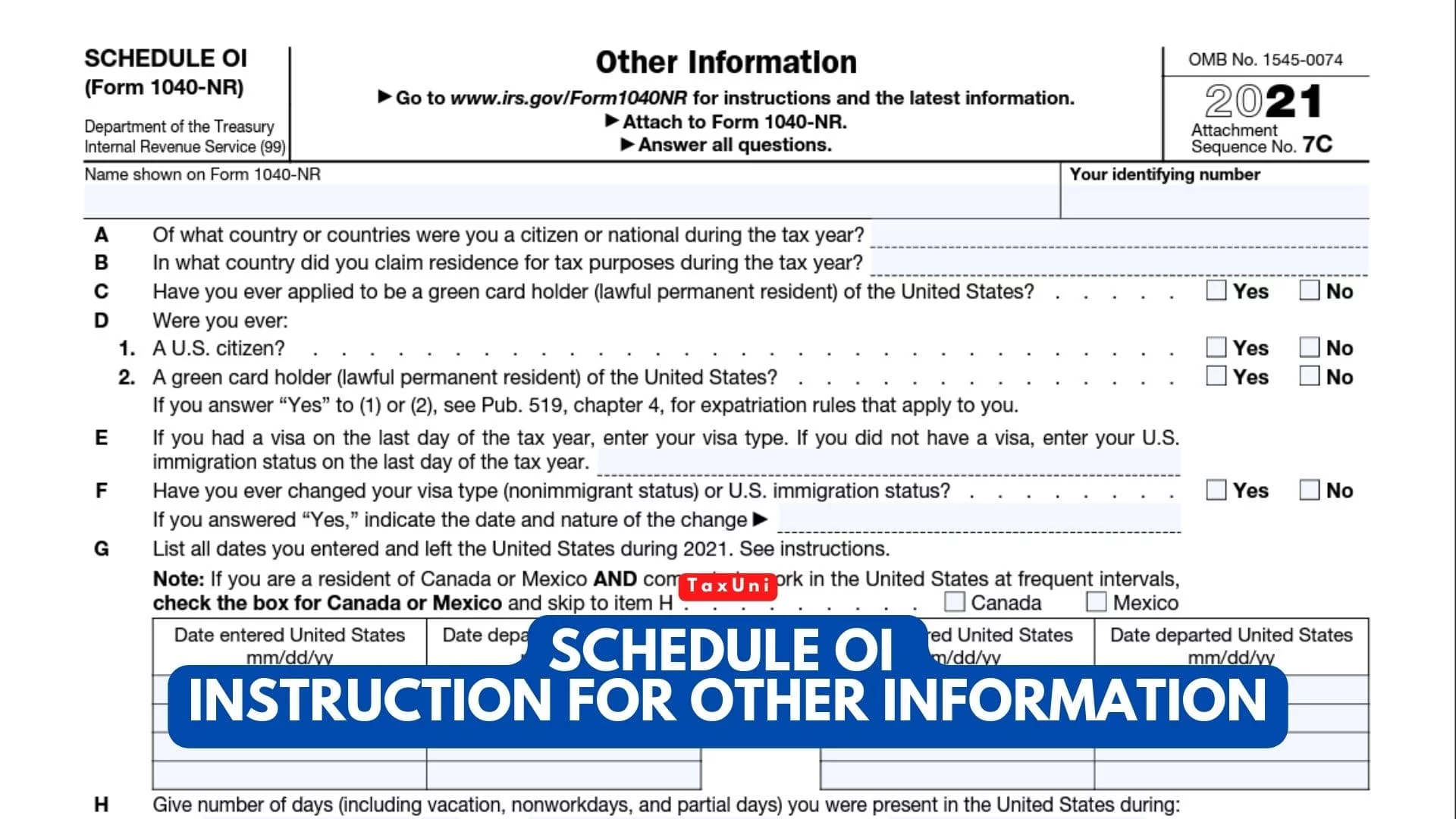

Schedule OI – Instruction For Other Information

Whenever you file your taxes, you need to fill out Schedule OI. This form is used to gather your country information and information about your prior tax years.

The Schedule OI is a part of Form 1040-NR. Once you’ve filled it out, you need to attach Schedule OI to Form 1040-NR. Those who live in the United States but are not citizens may need to file Schedule OI Form 1040-NR. This form collects information about your country of residence, your prior tax years, and information on U.S. income tax treaties. You can file the form online, by mail, or by e-file. You may be subject to penalties for failing to file a form.

It’s easy to complete a Schedule OI. It’s not one of those hard-to-complete IRS forms, but it’s also best to avoid troubling yourself with some tricky parts. Try our fill-out instructions for Scheule OI.

Schedule OI Instructions

- Line A: What country’s citizens were you during the last year? Enter its name.

- Line B: In what country you are going to claim residence for tax purposes during the tax year

- Line C: Have you ever applied for a green card? YES or NO.

- Line D: Were you ever:

- A U.S. Citizen?

- A Green Car holder?

- If you answer “Yes” to (1) or (2), see Pub. 519, chapter 4, for expatriation rules that apply to you.

- Line E: Enter your visa type if you had a visa on the last day of the tax year. Enter your U.S. immigration status on the last day of the tax year if you did not have a visa.

- Line F: You have changed your visa type or immigration status. YES or NO.

- Enter the date and nature of the change if you answered “YES“

- Line G: List all dates you entered and left the U.S. During 2021.

- Line H: Give the number of days (including vacation, non-workdays, and partial days) you were present in the United States during 2019, 2020, and 2021.

- Line I: You filed a U.S. income tax return for any prior tax year. YES or NO.

- If “Yes,” give the latest year and form number you filed.

- Line J: Are you filing a return for a trust?

- If “Yes,” did the trust have a U.S. or foreign owner under the grantor trust rules, make a distribution or loan to a U.S. person, or receive a contribution from a U.S. person?

- Line K: Did you receive total compensation of $250,000 or more during the tax year? If “Yes,” did you use an alternative method to determine the source of this compensation?

- Line L: Income Exempt From Tax—If you are claiming exemption from income tax under a U.S. income tax treaty with a foreign country, complete Lines 1-2 below. See Pub. 901 for more information on tax treaties.

- Line L1: Enter the name of the country, the applicable tax treaty article, the number of months in prior years you claimed the treaty benefit, and the amount of exempt income in the columns below. Attach Form 8833 if required.

- Line L1a: Country name

- Line L1b: Tax Treaty Article

- Line L1c: Number of months claimed in prior tax years.

- Line L1d: Amount of exempt income in the current tax year

- Line L1e: Total amount. Enter the total amount on Form 1040-NR, line 1c. Only enter it on Line 1a or Line 1b.

- Line 2: Were you subject to tax in a foreign country on any of the income shown in 1(d) above?

- Line 3: Are you claiming treaty benefits pursuant to a Competent Authority determination?

- If “Yes,” attach a copy of the Competent Authority determination letter to your return.

- Line M: Check the box here if:

- Line M1:This is the first year you are making an election to treat income from real property located in the United States as effectively connected with a U.S. trade or business under section 871(d).

- Line M2: You have made an election in a previous year that has not been revoked, to treat income from real property located in the United States as effectively connected with a U.S. trade or business under section 871(d).