Pub 514

This article aims to shed light on the key aspects covered in Publication 514, assisting individuals in better understanding and harnessing the benefits of the foreign tax credit.

Contents

Publication 514, Foreign Tax Credit for Individuals, or Pub 514 for short, is an IRS document that contains information on the Foreign Tax Credit (FTC). As a result, it’s useful for individuals who have foreign income and want to know how to claim it. It also provides details on the FTC’s limitations and rules for carrying forward and back unused credits. A common issue taxpayers face is a redetermination of their FTC for a given year. IRS Publication 514 serves as a valuable guide for individuals earning income from foreign sources and seeking to utilize the foreign tax credit.

By understanding the eligibility criteria, calculating the credit accurately, and navigating the limitations and reporting requirements, taxpayers can effectively utilize the foreign tax credit to minimize their U.S. tax liabilities. It is advisable to consult the publication directly or seek guidance from a tax professional for the most up-to-date and accurate information. With this knowledge in hand, individuals can confidently navigate the complexities of the foreign tax credit and optimize their tax planning strategies.

Eligibility and Calculation

Publication 514 lays out the eligibility criteria for claiming the foreign tax credit. To qualify, individuals must have paid or accrued foreign taxes to a foreign country or U.S. possession on foreign-sourced income. Additionally, there must be a U.S. tax liability on the same income. It is important to understand these prerequisites to determine if you meet the requirements for claiming the foreign tax credit.

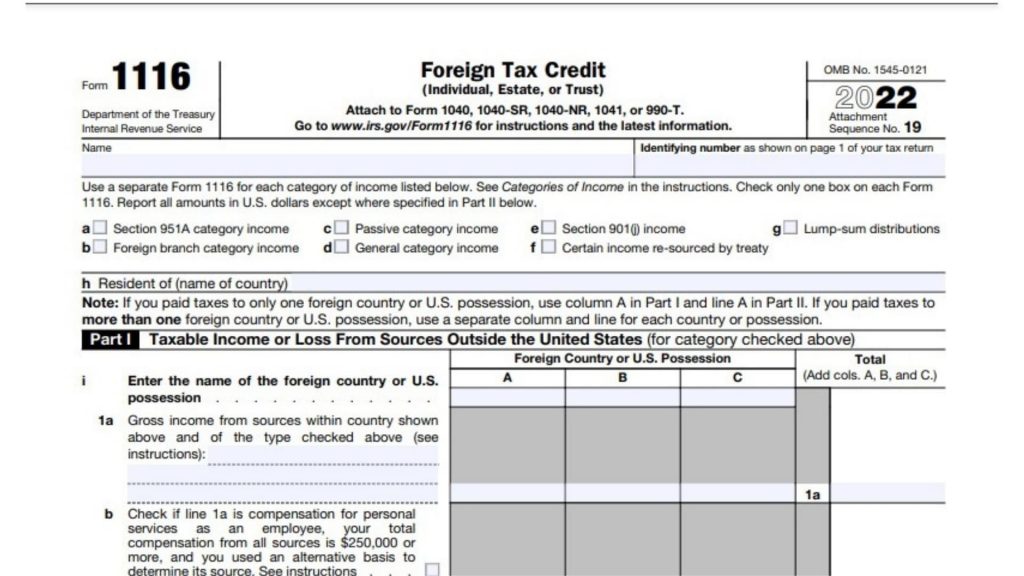

One of the primary focuses of Publication 514 is the calculation of the foreign tax credit. The publication provides step-by-step instructions on how to determine the allowable foreign tax credit amount. It details the process of completing Form 1116, which is used to report the foreign tax credit on your U.S. tax return. By following the guidelines presented, individuals can ensure accurate calculation and reporting of the foreign tax credit.

Limitations and Carryover Rules

While the foreign tax credit can reduce U.S. tax liabilities, there are limitations imposed to prevent double taxation. Publication 514 elucidates these limitations, including the foreign tax credit limitation based on taxable income. It helps taxpayers understand the cap on the amount of foreign tax credit that can be claimed in a given tax year. The publication also delves into the carryover and carryback rules, which allow unused foreign tax credits to be applied in subsequent years or carried back to prior years.

Special Considerations

Certain types of foreign taxes require special considerations in calculating the foreign tax credit. Publication 514 highlights these unique circumstances and provides specific instructions. Examples include taxes on excluded income or taxes related to foreign oil and gas income. By familiarizing oneself with the special rules, individuals can accurately determine their foreign tax credit entitlement in these specific scenarios.

Reporting Requirements

Publication 514 offers clarity on the reporting requirements associated with claiming the foreign tax credit. It outlines the necessary forms to be completed and provides guidance on where to report the credit on your U.S. tax return. Complying with these reporting obligations ensures that the foreign tax credit is appropriately accounted for and applied in the tax filing process.

Form 1116 and Pub 514

In Publication 514, the IRS provides guidance on calculating and reporting the foreign tax credit, which is claimed using Form 1116. While Publication 514 does not provide a line-by-line walkthrough of Form 1116, it references the form and provides instructions on how to use it in the context of claiming the foreign tax credit. Publication 514 typically mentions Form 1116 in the sections that discuss the foreign tax credit calculation, reporting requirements, and special considerations.