Payroll Calendar

The businesses have multiple calendars to help them keep track of everything. Whether you're an employee working for an employer or someone that operates a business, you should understand at least the payroll calendar so that you know when the wages are going to be paid.

Contents

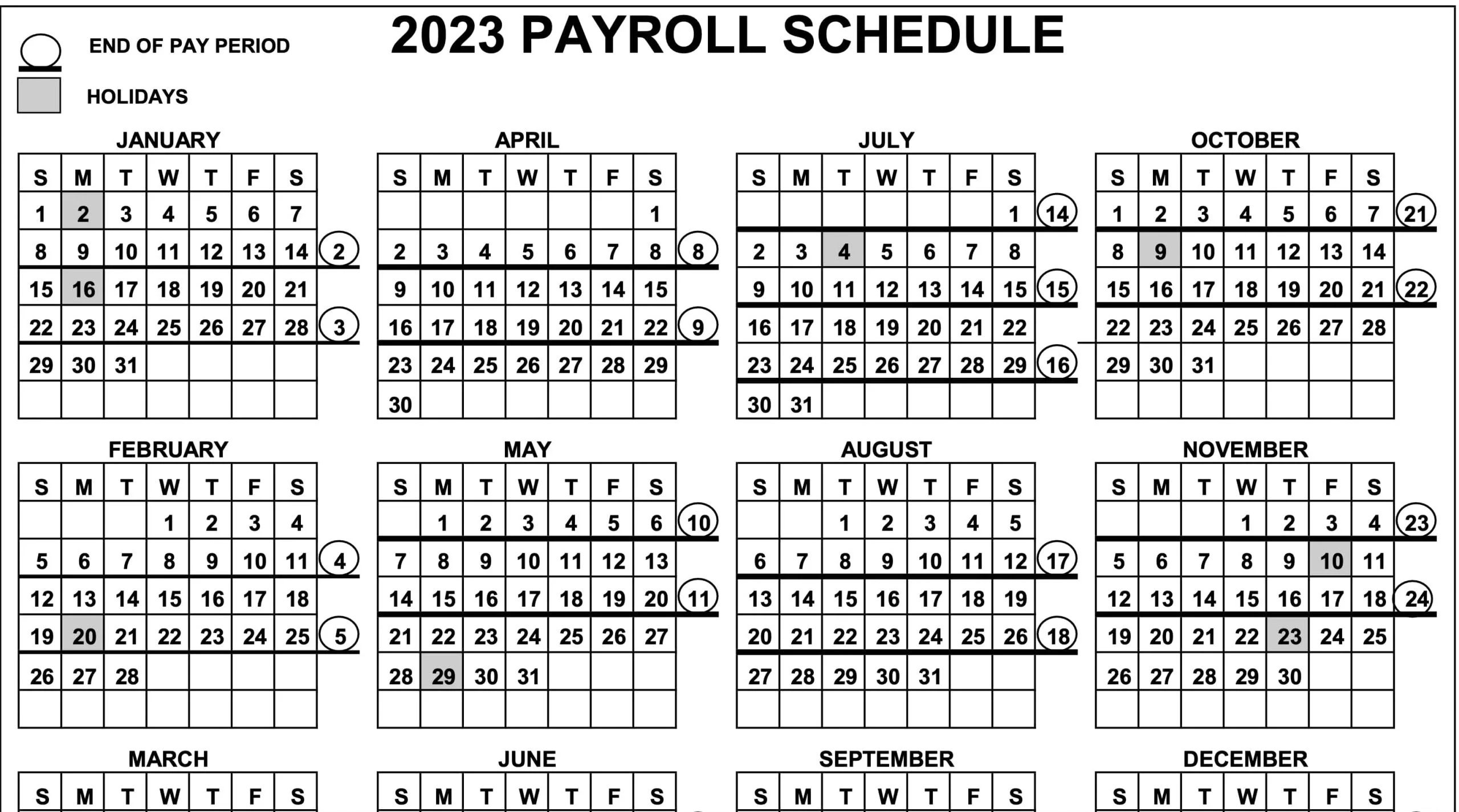

A payroll calendar is a document that sets out the start and end dates of pay periods. Employers use it to guarantee accurate payroll processing is completed promptly.

Selecting the ideal pay schedule can make a substantial impact on both your employees and your business. When making this decision, consider both your workforce needs and state regulations.

Pay frequency

Pay frequency is one of the most critical decisions you will face as a business owner. It immensely affects employee satisfaction, legal compliance, and cash flow.

Four popular pay frequencies exist: weekly, biweekly, semimonthly, and monthly. However, each has its advantages and drawbacks.

Selecting the ideal payroll frequency for your company is a personal decision and should be done with due consideration to employee expectations, financial planning, and time management. When making this decision, it’s essential to consider personal preference and cost factors. It is up to you to weigh the pros and cons carefully.

Biweekly pay is a popular option for hourly and salaried employees, providing an intermediate payment schedule between weekly and monthly checks. As such, it has become the most widespread pay frequency.

Holidays

Holidays are special days in the calendar when people can relax with family or friends. Additionally, they commemorate significant people, moments, and events that shape society or religion.

In the United States, most workers are entitled to a paid day off on certain holidays. These may be statutory holidays set by the government or individual worker contracts with their employer.

Though all these holidays share the same purpose, they may differ in how they’re observed. Typically, they involve a general suspension of work and business operations and public and religious ceremonies.

Bank holidays can cause a minor delay in the payroll process. To guarantee employees receive their paychecks on time, run your payroll one business day earlier than average to accommodate for bank closures.

Timesheets

Timesheets are an integral part of the payroll process, enabling you to track how long employees work on tasks. They also calculate total work hours, overtime, and double time for payroll purposes.

Timesheets can be completed manually or with timesheet software. No matter which option you opt for, ensure all employees use the same system to calculate their work hours as determined by management.

Timesheets must be completed and submitted by the due date or specified deadline to ensure timely payments. Failure to submit a timesheet by this deadline could cause issues with payroll processing and even lead to an audit.

Timesheets can provide many advantages, from streamlining payroll to guaranteeing your clients fair compensation. But before implementing such a system in your business, you should consider some things.

Taxes

Taxes are mandatory payments made by individuals and corporations to local, state, and national governments for programs like schools or roads.

In the United States, various taxes are levied; these include income and payroll taxes and sales taxes on the sale of goods and services.

Taxes that businesses must pay may differ from state to state. Payroll taxes are typically paid monthly or semi-weekly, depending on an employer’s payroll schedule.

Tax revenue is essential to finance public works and programs such as education, transportation, emergency services, health care, and social welfare. Furthermore, taxes have other purposes, like encouraging economic growth and international competitiveness.

The payroll calendar entirely depends on the pay frequency. Depending on the pay frequency, the number of pay periods in the tax year is determined. This will enable you to see many aspects of operating a business ahead as you will know when to process payroll and when to issue paychecks.

As mentioned, the payroll calendar you need depends entirely on the pay frequency. Generally, the pay frequency is either one of the following.

- Weekly

- Semi-monthly

- Monthly

These will determine the payroll calendar which you can then create your own and by marking the paydays and printing out a paper copy. It’s important to convert documents to a PDF file so that it becomes printable.

How to create a payroll calendar for federal employees?

What is biweekly payroll?

As we’ve mentioned on our list above, there are different payroll periods. One of the most common payroll periods is biweekly (also known as semi-monthly). If your employer pays you on a biweekly pay period, you will get paid twice a month, generally at the middle and end of the month.

Where can I get a printable payroll calendar? (PDF)

Most government agencies release a payroll calendar that is printable but this varies from agency to agency. The most commonly used payroll calendar is what the General Services Administration (GSA) shares. You can print out a paper copy of the GSA’s payroll calendar effortlessly below.