Missing Money Pennsylvania

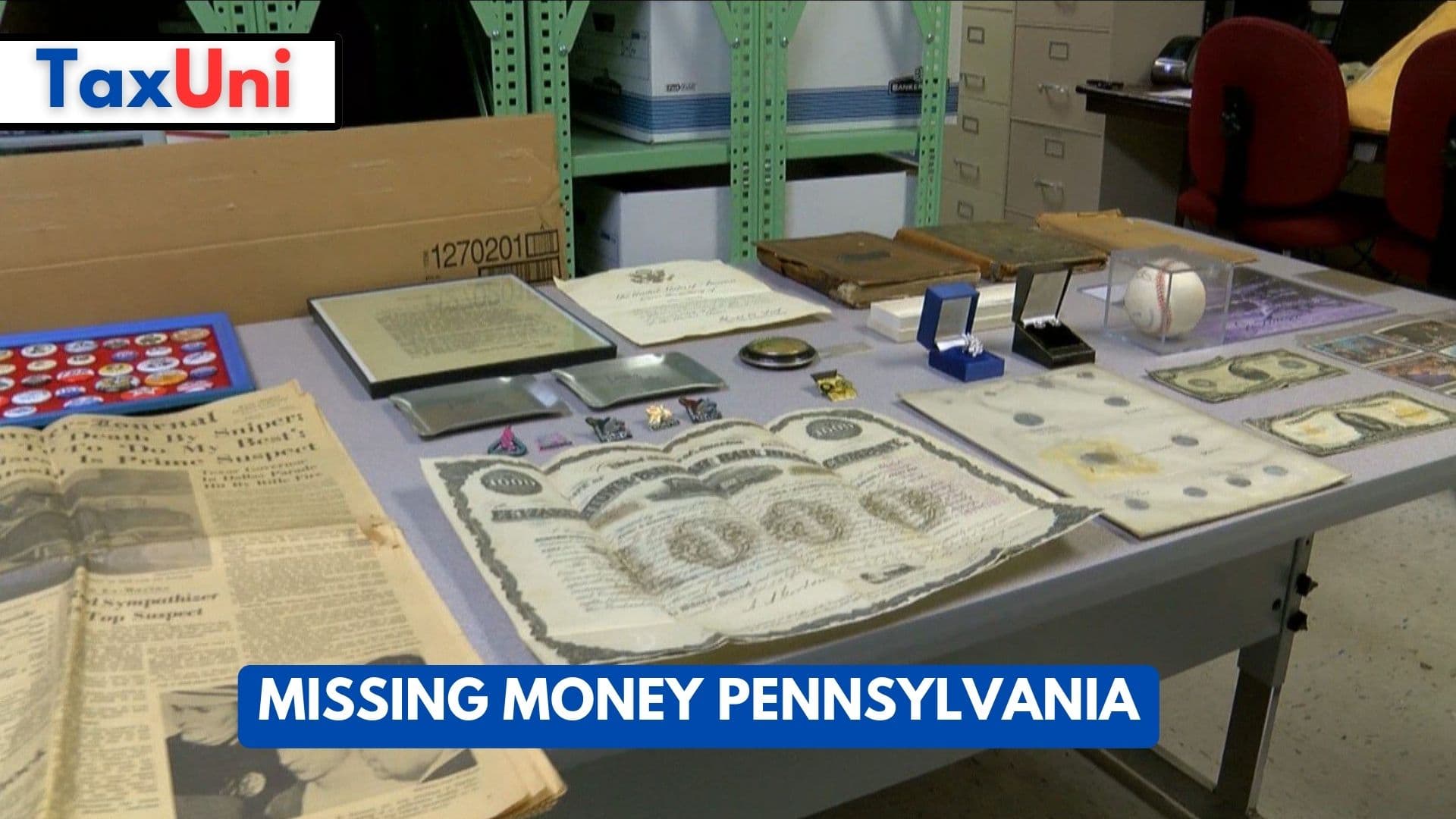

Billions of dollars are mingled in Pennsylvania's pool of unclaimed property. It includes dormant bank accounts, uncashed checks and items left in safe deposit boxes.

In Pennsylvania, the state treasurer holds the custody of property that hasn’t been claimed by its rightful owner for a period of time, which varies from three years to fifteen. This includes money, but also physical property such as heirlooms, jewelry, and military medals. The treasurer will attempt to find the rightful owners for three years before putting the property up for sale.

Interested persons can search the state government’s unclaimed property database to see if they are owed funds. The database lists a variety of property types, including old bank accounts, insurance refunds, and even unpaid wages from a previous job. The Bureau of Unclaimed Property Search Index provides a simple search using the original owner’s name and associated address. Search results are accompanied by the approximate amount of money left unclaimed and the property ID number.

The process for claiming property varies from state to state, but most require claimants to provide proof of identity and other supporting documentation. In some cases, this may include a notarized document such as a birth certificate or marriage license. Immediate family members and authorized representatives can file claims on behalf of deceased relatives by submitting vital records. The average timeline for processing a claim depends on administrative workload and the submission of necessary documentation. However, most individuals who search for missing money in Pennsylvania can receive their funds within 60 days.

What is the Unclaimed Funds Law in Pennsylvania?

The Pennsylvania Disposition of Abandoned and Unclaimed Property Act authorizes the state treasurer to take custody of financial assets and certain tangible property that are dormant after a period of time, which varies by type. The office takes temporary ownership and remits the funds to the rightful owner, immediate family members or authorized representatives after an appropriate dormancy period has expired.

The state has a long history of proactively returning some of this money back to its rightful owners. It also has a database that allows people to search for forgotten check amounts, gift cards and tax refunds that have been lost or misplaced. In addition to the database, the state has a number of ways for people to report lost property.

Pennsylvania’s Treasury Department has stepped up its enforcement of the unclaimed property law. In recent years, it has sent letters to companies that have never filed an unclaimed property report and asked them to self-audit their records. It is working with Verus Analytics, a company that specializes in conducting unclaimed property audits.

A new law in September 2016 added a “due diligence” requirement to the state’s unclaimed property laws. This requires holders of reportable properties valued at $50 or more to send notice by first class mail or electronically to the owner of each property. The law also required holders to submit an annual unclaimed property report by April 15 for reports that contain 10 or more properties.