How to Resolve the Issue for CP11?

This article is about navigating the process of resolving issues related to IRS Notice CP11, which is sent when the IRS identifies errors on your tax return, resulting in a balance due. It provides guidance on understanding the notice, agreeing or disagreeing with the IRS's adjustments, and the steps to take in either case to resolve the issue efficiently.

Contents

How to Resolve the Issue for CP11? This is guide for anyone who has received an IRS Notice CP11, indicating that the IRS has made changes to their tax return due to a miscalculation, leading to a balance due. This notice, often referred to as a “Notice of Changes to Your Return,” is typically sent when the IRS detects errors in income, deductions, or credits on your Form 1040. Receiving a CP11 notice can be unsettling, especially if you’re unsure about how to proceed. However, understanding the process and taking the right steps can help you resolve the issue efficiently. The notice will outline the adjustments made by the IRS, explain how these changes affect your tax liability, and provide instructions on what actions to take next. Whether you agree with the IRS’s adjustments or believe they are incorrect, knowing how to respond appropriately is key to avoiding further complications, such as additional penalties or interest charges. This article will walk you through the steps to review the notice, agree or disagree with the changes, and make necessary payments or arrangements to resolve the issue.

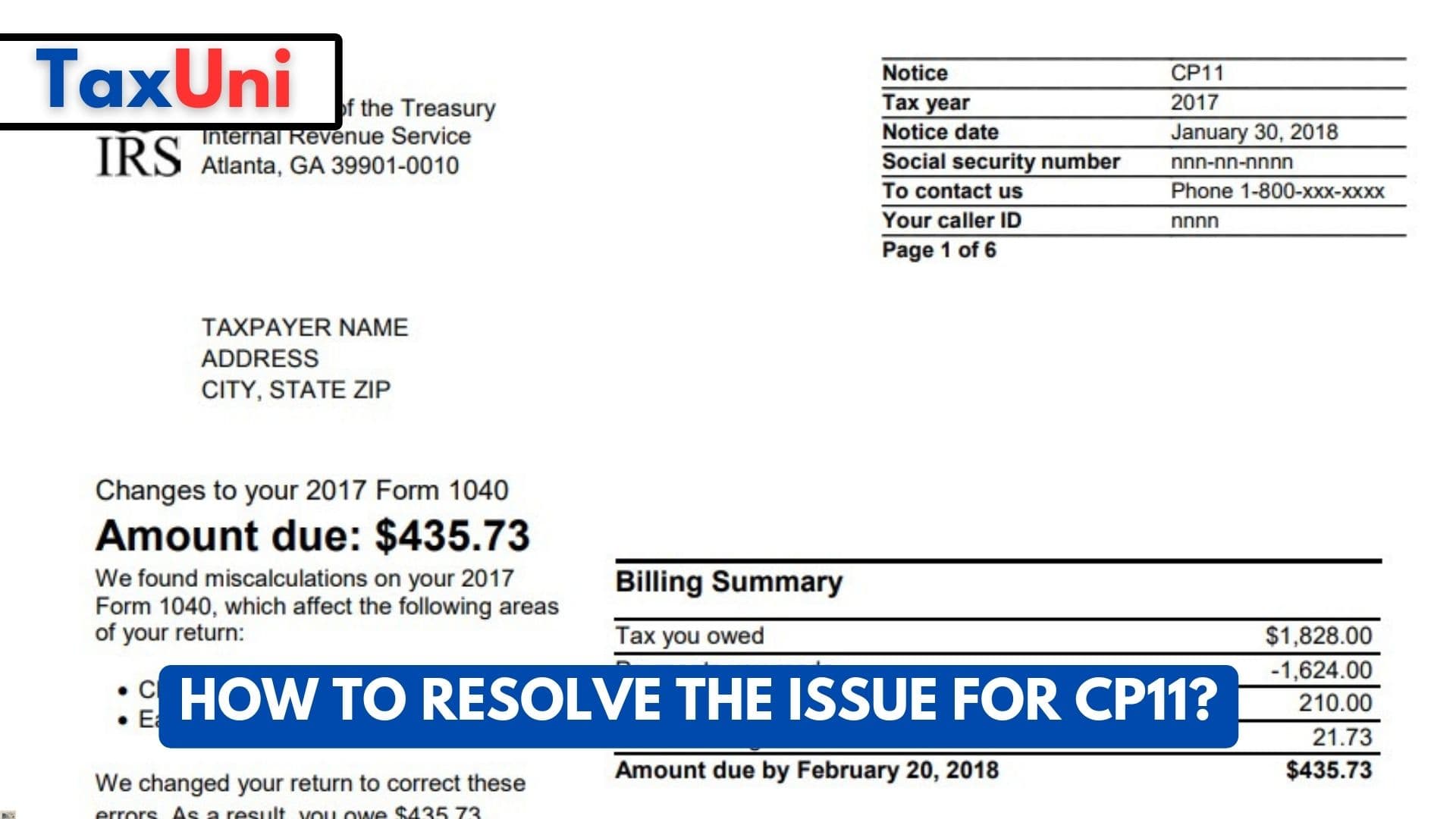

Understanding the CP11 Notice

The first step in resolving a CP11 notice is to thoroughly review the document. The notice will detail the specific changes made by the IRS, including any adjustments to income, deductions, or credits, and explain why these changes resulted in a balance due. It’s crucial to compare this information with your original tax return and supporting documentation, such as W-2s or 1099s, to ensure the IRS’s adjustments are accurate.

Why You Received the Notice

You received the CP11 notice because the IRS identified a miscalculation on your tax return. This could be due to a mathematical error, incorrect reporting of income, or other discrepancies. The notice serves as an opportunity for you to review and respond to these changes.

Agreeing with the Changes

If you agree with the adjustments made by the IRS, you should:

- Correct Your Records: Update the copy of your tax return that you kept for your records to reflect the IRS’s changes. However, do not send this corrected return to the IRS.

- Pay the Amount Due: Make arrangements to pay the additional tax liability by the deadline specified on the notice. You can pay online through the IRS website or by mail using the payment coupon provided with the notice. If you cannot pay the full amount, consider setting up a payment plan with the IRS.

Disagreeing with the Changes

If you disagree with the IRS’s adjustments, you must respond within 60 days from the date of the notice:

- Contact the IRS: Call the phone number listed on the notice or write to the IRS at the address provided. Explain why you disagree with the changes and provide supporting documentation to substantiate your claim.

- Provide Additional Information: Ensure you have all relevant financial documents ready to support your position. This could include receipts, invoices, or other records that justify the figures on your original return.

Setting Up a Payment Plan

If you agree with the changes but cannot pay the full amount due, you can set up a payment plan with the IRS:

- Online Payment Agreement Tool: Use the IRS’s online tool to create an installment agreement. This allows you to pay your tax debt in monthly installments.

- Contact the IRS Directly: If you prefer, you can call the IRS to discuss payment options. They can guide you through the process of setting up a payment plan.

FAQs

What should I do if I agree with the IRS’s changes on my CP11 notice?

Update your records, pay the amount due by the deadline, and consider setting up a payment plan if needed.

How do I dispute the changes made by the IRS on a CP11 notice?

Contact the IRS within 60 days, provide supporting documentation, and explain why you disagree with the adjustments.