How to Get a Montana Sales Tax License?

In this guide, we will explore the nuances of tax regulations in Montana, outline the steps businesses must take to comply with tax requirements, and provide an overview of the local resort taxes that may necessitate a license in certain jurisdictions.

Contents

Montana is unique among U.S. states because it does not impose a statewide sales tax. This means that, unlike in other states, businesses in Montana are not required to obtain a sales tax license to collect sales tax from customers. This lack of a general sales tax creates a more straightforward regulatory environment for businesses operating within the state. However, businesses still need to be aware of other tax obligations, such as the Montana Corporate Income Tax and local resort taxes that may apply in specific areas.

Why Montana Does Not Require a Sales Tax License?

Montana is one of five states in the U.S. that does not have a statewide sales tax. As a result, there is no need for businesses to obtain a sales tax license to collect and remit sales tax to the state. This policy is rooted in Montana’s long-standing commitment to maintaining a low-tax environment to attract businesses and residents. The absence of a general sales tax simplifies the tax compliance process for businesses, allowing them to focus on other aspects of their operations.

How to Register a Business in Montana?

Starting a business in Montana requires several key steps to ensure your business is legally registered and ready to operate. While Montana does not require a general sales tax license, businesses still need to navigate the state’s registration process to comply with local regulations. Here’s a detailed guide to help you through the Montana business registration process:

- Choose a Business Structure: The first step in registering your business in Montana is to decide on a legal structure. This could be a sole proprietorship, partnership, corporation, or limited liability company (LLC). Each structure has different implications for liability, taxes, and management, so it’s crucial to choose the one that best suits your business needs.

- Register Your Business Name: If you plan to operate under a name different from your own or the official name of your corporation or LLC, you’ll need to register a “Doing Business As” (DBA) name with the Montana Secretary of State. This ensures that your business name is unique and not already in use by another entity in the state.

- File Articles of Incorporation or Organization: For corporations and LLCs, you’ll need to file the appropriate formation documents with the Montana Secretary of State. Corporations file Articles of Incorporation, while LLCs file Articles of Organization. These documents formally create your business entity and establish its legal existence in Montana.

- Obtain an Employer Identification Number (EIN): If your business has employees, or if you operate as a corporation or partnership, you’ll need to obtain an EIN from the IRS. This number is used for tax reporting purposes and is required to open a business bank account.

- Register for State Taxes: Even though Montana does not have a sales tax, businesses must still register with the Montana Department of Revenue for other applicable taxes, such as corporate income tax or withholding tax for employees. You can register online through the Montana Taxpayer Access Point (TAP).

- Acquire Necessary Permits and Licenses: Depending on your business type and location, you may need to obtain local permits or licenses to operate legally in Montana. This can include health permits, environmental permits, or professional licenses.

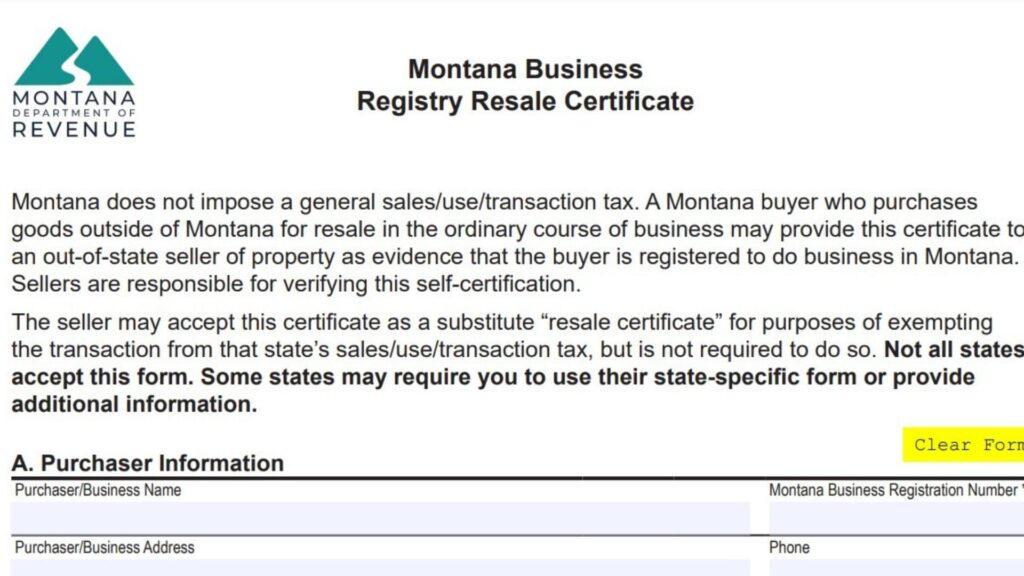

What is Montana Business Registry Resale Certification?

While Montana does not impose a statewide sales tax, businesses that purchase goods for resale or manufacturing may need to obtain a Montana Business Registry Resale Certificate. This certificate allows businesses to purchase goods without paying sales tax, which can then be resold or used in the production of goods that will be sold.

Who Needs It?: Businesses that buy products wholesale to resell to customers, or businesses that manufacture products, can benefit from a resale certificate. This is especially important if your business operates in multiple states or has customers outside Montana.

How to Obtain a Resale Certificate?: To obtain a Montana Business Registry Resale Certificate, you typically need to provide proof of your business registration, a valid EIN, and details about the nature of your business. The application process is straightforward and can often be completed online through the Montana Department of Revenue’s website.

Using the Resale Certificate: Once you have your resale certificate, you can present it to wholesalers or suppliers when purchasing goods for resale. This exempts your business from paying sales tax on those purchases, helping you to manage your costs more effectively.