Get Tax Transcripts Online

The Internal Revenue Service allows taxpayers to obtain their tax transcripts online using the Get Transcript tool. View your tax transcripts online using this tool or order them by phone or mail. Assuming you have access to the internet, you can just order tax transcripts online.

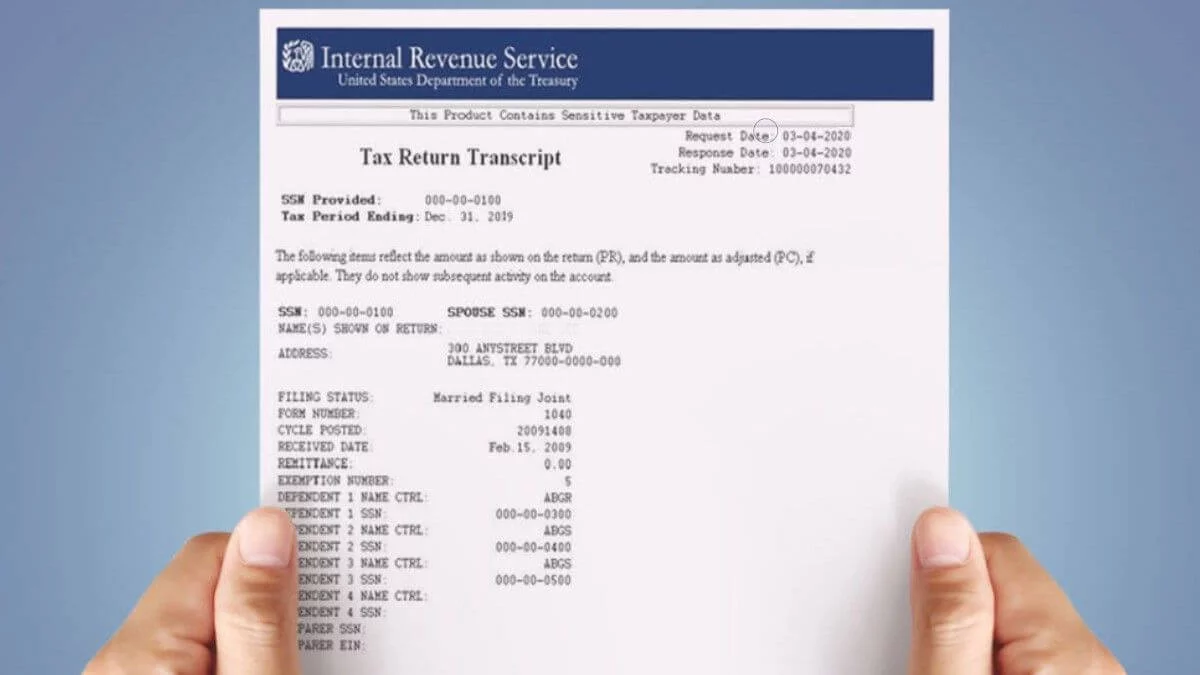

Before we get to how to obtain tax transcripts online, let us explain what a tax transcript provides you with. First and foremost, if you’re looking to find your adjusted gross income due to a request from a financial institution, you will need to obtain a tax transcript even if you know the exact amount.

A tax transcript is basically a summary of your tax return information. You can get tax return transcripts to see your adjusted gross income and tax forms used for filing a tax return.

In addition to your tax return transcripts, you can obtain tax account transcripts. This transcript shows basic information regards to your filing status, adjusted gross income, taxable income, a return type(s), and payments. If you’ve made changes to your original return after filing, you can also see the changes by requesting a tax account transcript.

Request Transcripts Online

By requesting tax transcripts online, you will be able to have all the information necessary on your prior-year tax returns. To request a transcript online, you will need:

- Social Security Number

- Date of Birth

- Mailing Address from latest tax return

- Filing Status

- Access to your e-mail account

- A mobile phone number under your name.

- Personal Account Number from a credit card, mortgage, car loan, home equity line of credit, home equity loan, or mortgage.

As long as you have the above, you can request tax transcripts online. Click here to go to IRS Get Transcript Online.

Request Transcripts by Mail or Phone

To request tax transcripts by phone, call 1-800-908-9946. Upon calling this number, you will be asked to verify your identity and a series of questions will be asked by an IRS representative to ensure that.

As for requesting tax transcripts by mail, you first need to file Form 4506-T or Form 4506T-EZ and mail it to the IRS. Learn more about Form 4506-T and where to mail it. Take note that you might wait up to two weeks for your tax transcripts to be mailed to you by the IRS. If you’re in a hurry, requesting tax transcripts online is the best option.

I have been waiting for 5 weeks for copies of my W2’s from the past 7 years. Is there anyway that I can have them emailed to me? I owe the IRS and need to get this taken care of. Thank you.