Form 926

If you are a United States resident and want to transfer property to a foreign corporation, you will need to file a form called IRS Form 926.

If you own a property or have been involved in a business transaction that involves transferring a property to a foreign corporation, you may need to file Form 926. It is important to be familiar with the form’s requirements and to file it with your tax return.

The form has detailed sections on transfers of property to foreign corporations. You are required to fill out Form 926 if you transfer more than $100,000 to a foreign corporation over a 12-month period. Regardless of the amount, a penalty may be levied for failure to file.

The form can be a little confusing. You must also name the shareholder with the most power and give a basic description of the property that is being transferred. Depending on the type of property transferred, you might need to fill out additional forms.

Form 926 is a very complex form. There are many technicalities, so it is recommended that you get advice from a tax professional if you need clarification on the instructions. If you don’t file, you could have to pay a fine of up to 10% of the property’s fair market value.

How to Fill Out Form 926?

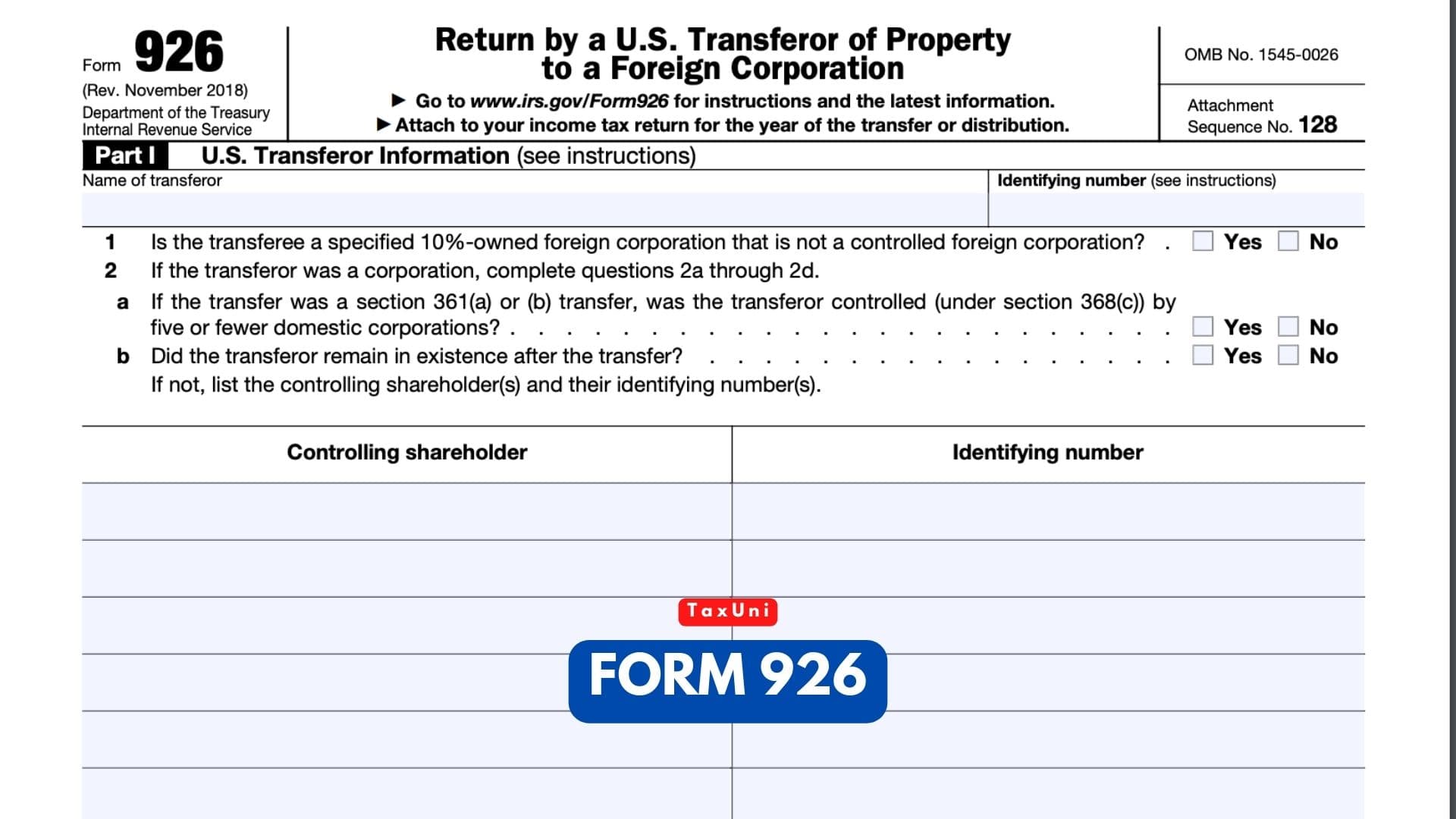

There are three main parts to Form 926:

- The first part asks for basic information. You should give the date of the transaction, the type of property transferred, and if the property was intangible.

- The second part requires you to identify the transferor. You should answer whether the person was a domestic or foreign corporation.

- Part III is where you report the details of the transfer. Generally, you will need to provide the transferor’s name, the transfer date, the property’s value, and if you received any consideration. In addition, you should provide information on the amount of gain and loss that was realized on the transferred stock.

If you’re transferring more than 10% of the voting power or total stock of a foreign corporation, you should fill out Form 926. Section 6038B of the Internal Revenue Code says that information has to be given about these transfers.

Depending on the type of transaction you are making, you may also need to give information about the person receiving the money. You should list the EIN of the transferee’s parent corporation. You should also indicate the name of any affiliated groups.