Form 8965

If you or a member of your household has coverage or a coverage exemption that doesn't cover every month of the year, you may need to file form 8965. A tax professional can help you determine if you need to submit this form.

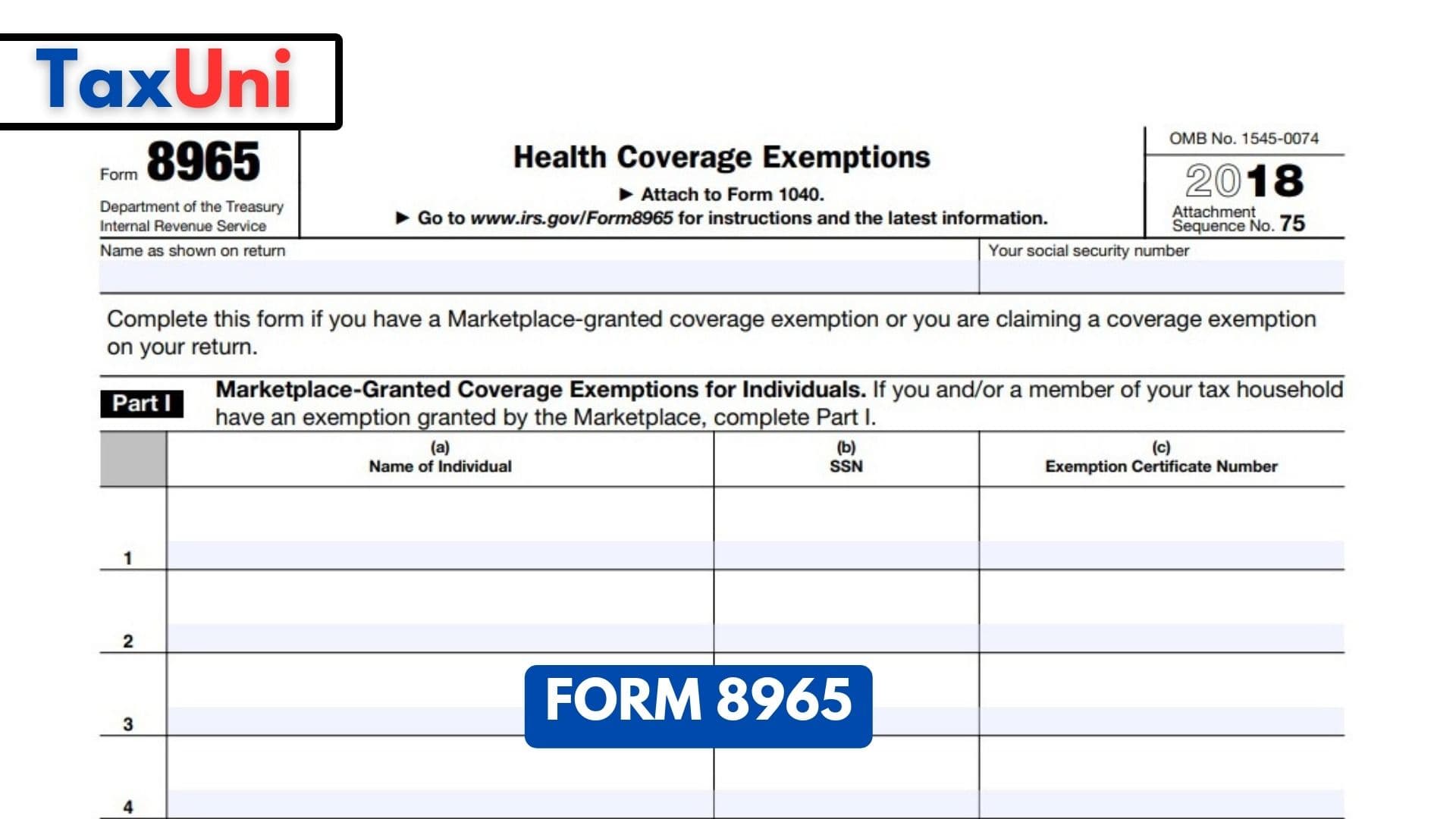

Form 8965 is a Health Coverage Exemptions form used by individuals to report or claim coverage exemptions. It was required by the Affordable Care Act (ACA) for individuals to file with their annual tax returns if they did not have insurance. In addition, if they did not have insurance and didn’t file this form, they were subject to a penalty known as the Shared Responsibility Payment. This penalty was abolished with the 2017 Tax Cuts and Jobs Act, so this form no longer applies to tax years after 2019. To fill out this form, you will need your 1095-B, an IRS document showing you had minimum essential coverage for one or more months during the year. You will also need to consult the “Types of Coverage Exemptions” chart in the 8965 instructions to find out which letter code you should enter in part III of the form to indicate your exemption.

Who Must File Form 8965?

If you and other members of your household qualify for a health care exemption, you must file Form 8965 with your tax return. Exemptions are available for a variety of circumstances. Some require you to apply through the Marketplace (also known as an exchange). Others you can claim by filling out this IRS form and attaching it to your tax return.

Household income for the purposes of this form is modified adjusted gross income (MAGI) plus the MAGI of each individual in your tax household that you claim as a dependent and who is required to file a tax return. If any of the individuals in your household aren’t required to file a tax return because their income is below the filing threshold, enter their income information on Part II of Form 8965.

How to Fill out Form 8965?

The 8965 form has three parts. The first part should be used to report any Marketplace-granted exemptions and includes the name, Social Security number, and the exemption certificate number of each member of your household. The second part is used to report any income-based coverage exemptions that you or a member of your family qualifies for, such as the Cost Sharing Reduction (CSR) or the Medicare Savings Program. The third part is used to report any other non-Marketplace-granted exemptions, such as religious freedom or incarceration.

If you do not have any exemptions and your household income is below the filing threshold, you do not need to file Form 8965. However, you must still file your tax return and certify that your income is less than the filing threshold. You will also need to verify that you do not owe a shared responsibility payment on your return. Contact a financial advisor if you have any questions about submitting Form 8965. They can help optimize your tax strategy for your personal situation.