Form 8829

Form 8829 is a vital IRS tax form for self-employed individuals and freelancers. This article will provide must-know information on Form 8829 for taxpayers.

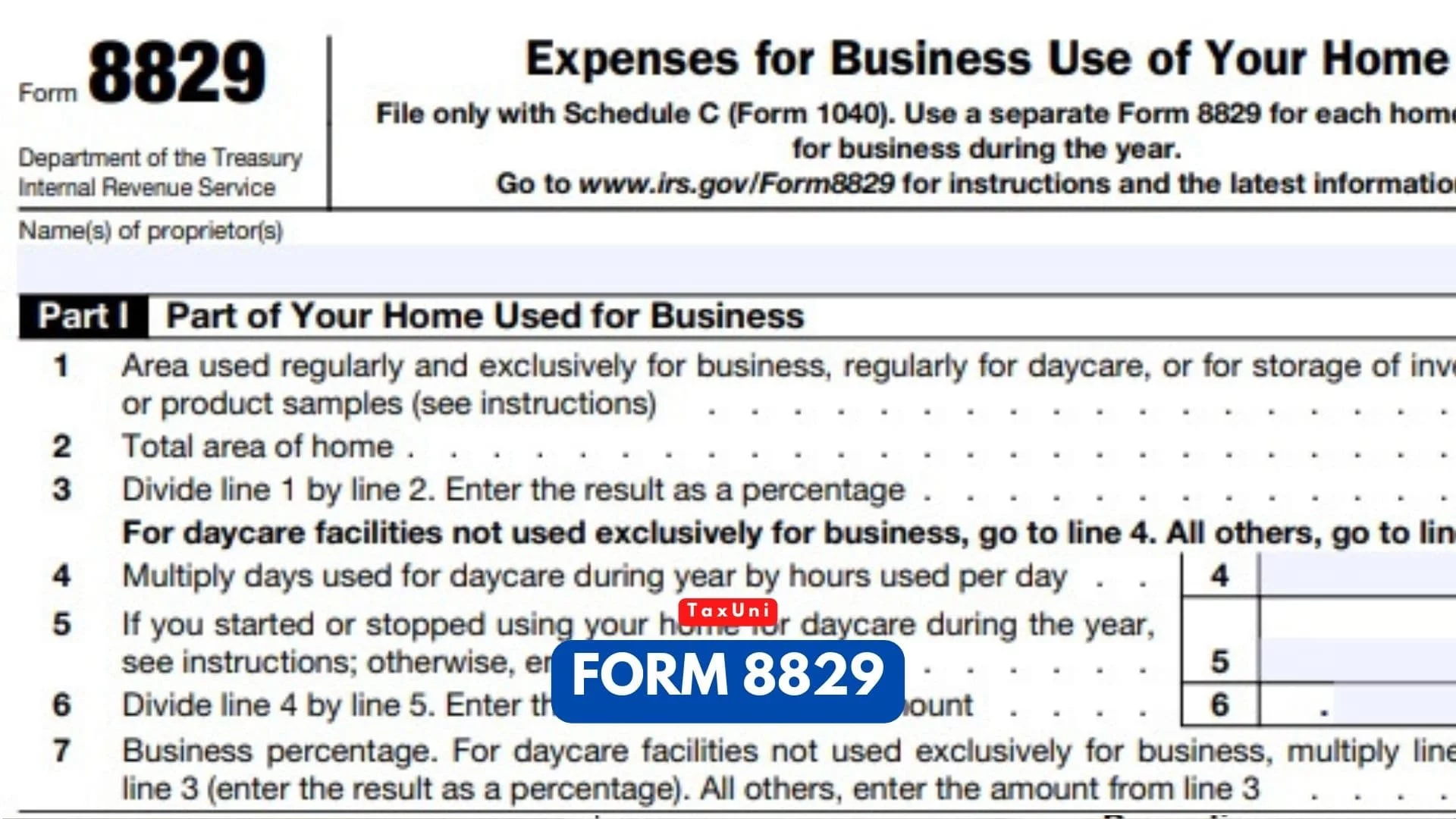

Form 8829, Expenses for Business Use of Your Home, is an IRS form that self-employed people use to claim a tax break for their home offices. It is a popular way for small business owners to reduce their overall business taxes. However, the deduction is limited and can be confusing to fill out. To claim the home office deduction, you must use a space exclusively used for business purposes. This is usually your principal place of business.

The main reason to file Form 8829 is to reduce your overall business taxes. There are two ways to do this, and it’s important to choose the method that works best for you. You can either claim the simplified method and report it directly on Schedule C or file Form 8829 to calculate your total deduction.

How to Qualify for Home Office Deduction?

The IRS defines a home office as a room, space, or area in your home that is used exclusively and regularly for the purpose of your business. The space must not be part of a regular living space, like a kitchen or bedroom, and the area must be separate from any other rooms. You must use Form 8829 with Schedule C (Form 1040) to qualify for a home office deduction. This means that sole proprietors, partners in partnerships, and members of limited liability companies, as well as shareholders in S corps and C corps, need to file this form along with their personal tax returns.

For business owners who own their own homes and want to take advantage of the deduction, it is important to keep accurate records when filling out Form 8829. These records can help you determine which expenses are allowable and how much you can claim. Lines 1-3 of Form 8829 ask you to enter the total square footage of the area in your home you use for your business. For this, you should measure the area with a tape measure. Using floor plans from when you bought or moved into your home is also a good idea.

If your home has two or more rooms used for business purposes, you can list each separately on a separate screen. This can make the process a little easier, but it’s important to be accurate here. Getting a qualified tax professional involved in your first year of filing Form 8829 since they can help you determine which expenses are allowed and which aren’t. For example, if your business involves storing inventory in your home office, you can’t claim that expense on Form 8829, but you can deduct it on Schedule C Part III, the cost of goods sold.

How to Fill Out Form 8829?

Home office deductions are often a boon for freelancers and small businesses, but they can be tricky to understand. Here’s how to file Form 8829 correctly and get the most out of it. The first step in filling out Form 8829 is determining the percentage of your home you use for business. This is the percentage that will help you figure out your deduction amount, so it’s important to get this part right. You can calculate this percentage by dividing your home office’s total area by your home’s entire area. For example, if your home office is 50 square feet and your entire home is 900 square feet, you would divide 900 by 50 to get 6%. You will use this percentage throughout the rest of the form to figure out your allowable home office deduction.

Once you’ve determined your deductible percentage, you can begin listing your home office space expenses. This will include both direct and indirect expenses. You’ll need to make sure that you have a detailed record of your expenses so it’s easy for the IRS to check them against the numbers on your form. Another thing that will play a role in the size of your home office deduction is depreciation on your home. This means that your home office will be depreciated based on how much you’ve used it for business purposes. This is important because it will ensure that your deductible home office expenses don’t exceed the depreciation limit. This is a great way to save money on your taxes, so be sure to keep accurate records.

You’ll also want to consider any casualty losses you’ve had to deal with this year, such as a fire or water damage. These losses will be multiplied by your business percentage to create the final allowable home office deduction. Lastly, you’ll need to enter any other deductible expenses you haven’t listed in Part II of the form. These include advertising costs, legal fees, and payments to independent contractors or employees. This can be a little tricky, so it’s best to seek help from a tax professional.

Form 8829 Instructions

There are specific parts in Form 8829 that you should be extra careful when filling out:

- First, it’s important to know your square footage. This will help you determine how much of your home is used for business. For example, if you run a daycare facility in your home, you must calculate how much of the total square footage is dedicated to the business.

- To determine the percentage of your home that is used exclusively for business, divide the area of the home that you use exclusively for business by the entire square footage of the home. This will give you your business percentage, which will guide your deductible amount.

- Lines 40 through 42 will ask you to calculate your home’s depreciation rate, the percentage of your home’s value that can be claimed as a business deduction. You can find this information on your tax return or through a web-based tool like Bonsai.

- Once you have this figure, enter it on lines 41 through 43. This will let you calculate the amount of your home’s depreciation you can claim for the year.

- Next, if you have an excess casualty loss from what you entered on line 9, multiply the excess amount by your business percentage (line 7). You can also override the IRS’s percentage calculation and override it with your own percentage figure in field 7. However, if you do this, you must prepare an explanatory statement and attach it to your computation.

- Then, you’ll add up all the expenses listed on Lines 29 through 31. If you have any unallowed expenses you couldn’t deduct last year, carry them over to this year on Line 31.