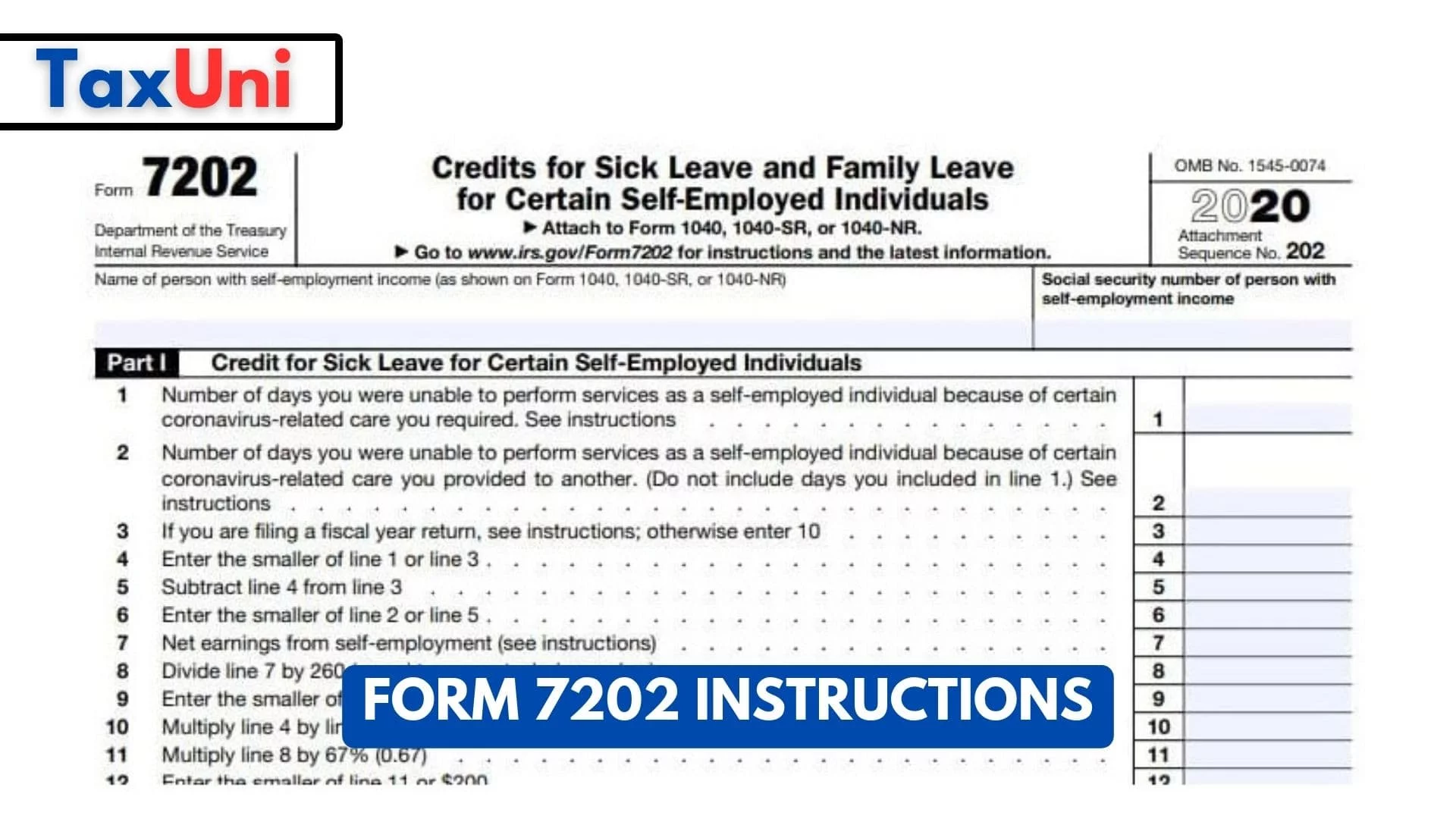

Form 7202 Instructions

Form 7202 is a new IRS form that will help self-employed people claim sick, and family leave tax credits under the Families First Coronavirus Response Act. This article will cover the purpose of Form 7202 and its instructions.

Form 7202 is a tax return form that helps self-employed individuals affected by the coronavirus (COVID-19) to claim a credit for sick and family leave wages. Eligible self-employed individuals can claim the credit if they were required to take sick or family leave between April 1 and December 31, 2020, due to COVID-19 restrictions that were in place at their workplace or because of a family member who had the disease. The credit is equal to qualified sick leave or family leave wages.

This credit allows eligible self-employed individuals to take a small slice of time off from work and still pay their taxes without penalty. This credit is the largest single tax benefit available to self-employed individuals, averaging about $15,110 per year. The credit can be claimed in your 2020 income tax return, or you may opt to use prior year net self-employment earnings to calculate the credit. To find out more, download and print a copy of Form 7202 or visit the IRS’s website.

Form 7202 Eligibility

- You must be an eligible employer under the FFCRA. This generally includes private-sector employers with fewer than 500 employees and certain public-sector employers. However, some exemptions and special rules exist for businesses with fewer than 50 employees.

- You must have provided your employees with qualified sick or family leave wages as required by the FFCRA. The FFCRA mandated certain employers to provide paid sick leave and expanded family and medical leave to employees affected by COVID-19. The specific circumstances and criteria for providing these leaves are outlined in the FFCRA.

- The wages you paid to employees for qualified sick or family leave must meet the criteria outlined in the FFCRA. There are limits on the amount of wages that qualify for the tax credits, and the calculation depends on various factors, such as the reason for the leave and the employee’s regular rate of pay.

- You must maintain appropriate documentation to support employees’ qualified sick or family leave wages. This may include records of the leave taken, the reason for the leave, and the corresponding wages paid.

How to fill out Form 7202?

You can fill out Form 7202 online or by printing and submitting it in person.

- When you are ready to complete Form 7202, you must enter your name and Social Security number (SSN). You can also enter your spouse’s SSN if they are filing a joint tax return with you. You must also enter your employer’s SSN if you are filing as self-employed.

- In addition, you will need to calculate the amount of the credit you are claiming. This can be done by multiplying the number of days you could not work due to a Covid-19 restriction by the amount of qualified sick leave wages you received.

- You can also calculate the family leave equivalent amount by multiplying the number of days that you are taking time off for family medical reasons by the amount of qualified family leave wages that you received.