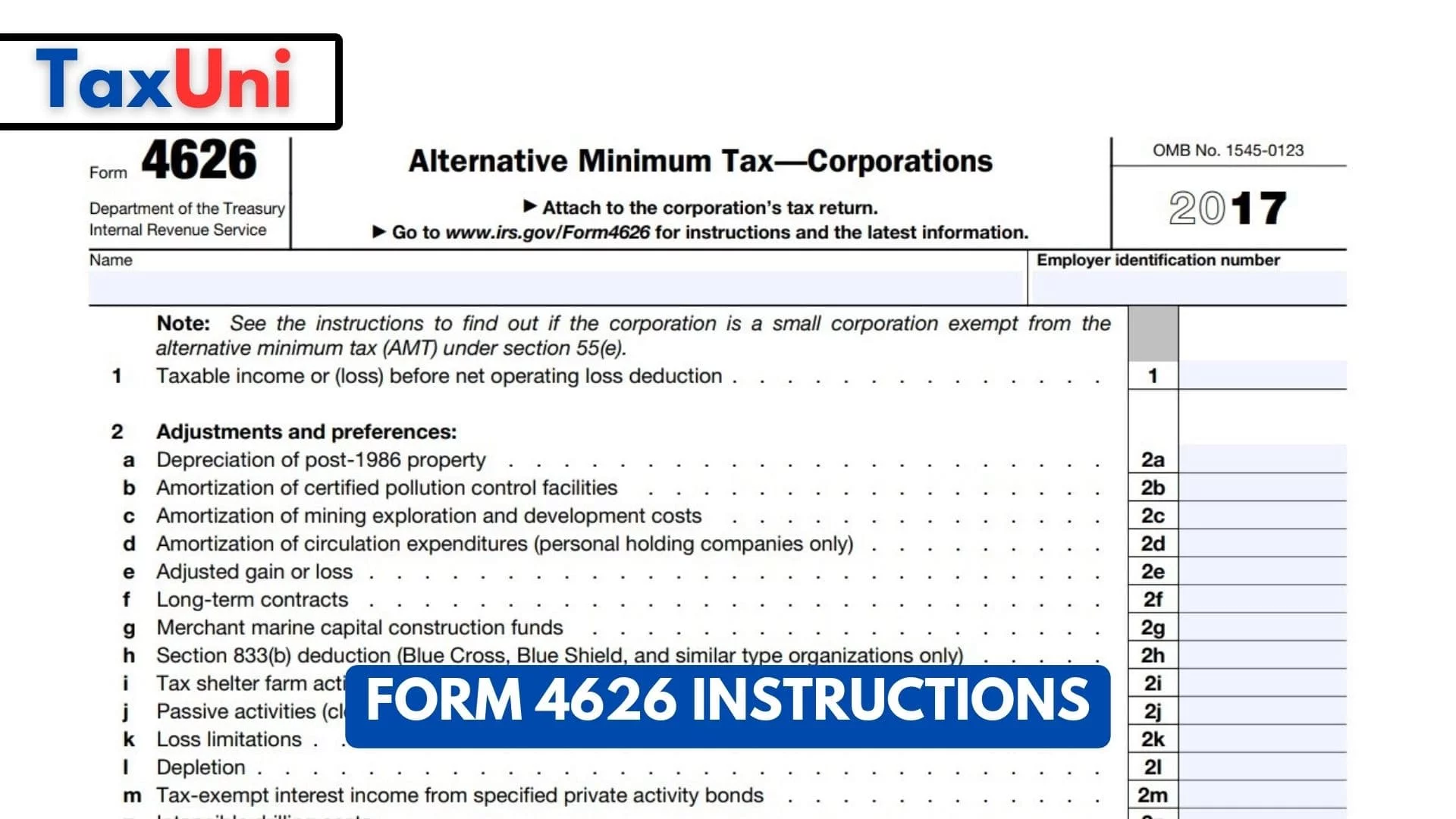

Form 4626 Instructions

The IRS Form 4626 is an important statement for enterprises liable for the Alternative Minimum Tax. This article will help you fill out this form without any trouble.

Form 4626 is required for all domestic corporations not exempt from the alternative minimum tax (AMT). A corporation must file this form if it has taxable income or losses that can generate an AMT liability. In addition, a corporation must file this form if it has any foreign tax credits that cannot be used against its regular tax liability because it does not meet one of the separate limitation categories set forth in section 1561. For example, a corporation that is an independent oil and gas producer and figured its regular tax depletion deduction under section 613A(c) must make a special adjustment for AMT purposes. To figure this adjustment, subtract the corporation’s AMT expense from its regular tax expense and enter the result on line 7 of the worksheet. If the AMT expense exceeds the regular tax expense, enter the difference as negative.

A special rule applies if a corporation qualifies as a small business corporation for the previous tax year but does not meet the gross receipts test for the current tax year and loses its exemption status. In this case, the corporation must complete Form 4626 based on special rules that allocate differently treated items between its investors. For example, a mining company that incurred a cost for exploration activities may choose to deduct these costs on a ratable basis over the period of time shown on its return.

How to fill out Form 4626?

The instructions for Form 4626 describe the procedures you must follow to determine a corporation’s alternative minimum tax (AMT) under section 55. The instructions explain the definitions of taxable income and deductible expenses as they apply to AMT and list the tax preference items that may be reduced under AMT. The instructions also describe how to compute AMT net operating loss carrybacks and forwards.

- Line 2a-2o: Adjustments and preferences:

- Line 3: Pre-adjustment alternative minimum taxable income (AMTI). Combine lines 1 through 2o.

- Line 4a-e: Adjusted current earnings (ACE) adjustment:

- ACE from line 10 of the ACE worksheet in the instructions

- Subtract line 3 from line 4a. If line 3 exceeds line 4a, enter the difference as a negative amount. See IRS instructions

- Multiply line 4b by 75% (0.75). Enter the result as a positive amount. (Line 4c)

- If line 4b is zero or more, enter the amount from line 4c

- If line 4b is less than zero, enter the smaller of line 4c or line 4d as a negative amount.

- Line 5: Combine lines 3 and 4e. If zero or less, stop here; the corporation does not owe any AMT.

- Line 6: Alternative tax net operating loss deduction. See IRS instructions.

- Line 7: Subtract line 6 from line 5. If the corporation held a residual interest in a REMIC to figure Alternative minimum taxable income

- Line 8: Exemption phase-out (if line 7 is $310,000 or more, skip lines 8a and 8b and enter -0- on line 8c)

- Line 11: Alternative minimum tax foreign tax credit (AMTFTC)

- Line 12: Subtract line 11 from line 10 to figure Tentative Minimum Tax.

- Line 13: Regular tax liability before applying all credits except the foreign tax credit

- Line 14: As the final thing to do, Subtract line 13 from line 12. If zero or less, enter -0-. Enter here and on Form 1120, Schedule J, line 3, or the appropriate line of the corporation’s income tax return to figure your Alternative Minimum Tax.

Instruction Notes

- The corporation’s AMTI on line 4d is the excess of the corporation’s total increases in ACE from prior year ACE adjustments over its total reductions in ACE from those prior years. This adjustment is a “running balance” of the limitation, and the corporation must keep adequate records from year to year to show this amount.

- Generally, the limit on a corporation’s AMT NOL carryback and carryforward for a particular tax year is 90% of AMTI determined without regard to the ATNOLD and any domestic production activities deduction under section 199. If the corporation made a previous AMT limitation election, skip this step and complete Schedule B, Part II, line 7.

- If the corporation is a member of a controlled group of corporations, subtract $150,000 from the combined AMTI for all members on line 8b. Then divide this amount among the members in the same way the $40,000 tentative exemption is divided. For each member, subtract its share of the AMTI limitation from its regular tax taxable income and report it on line 9 (AMTFTC).