Can You Use a Form 843 to Request a Penalty Abatement for a Partnership?

Contents

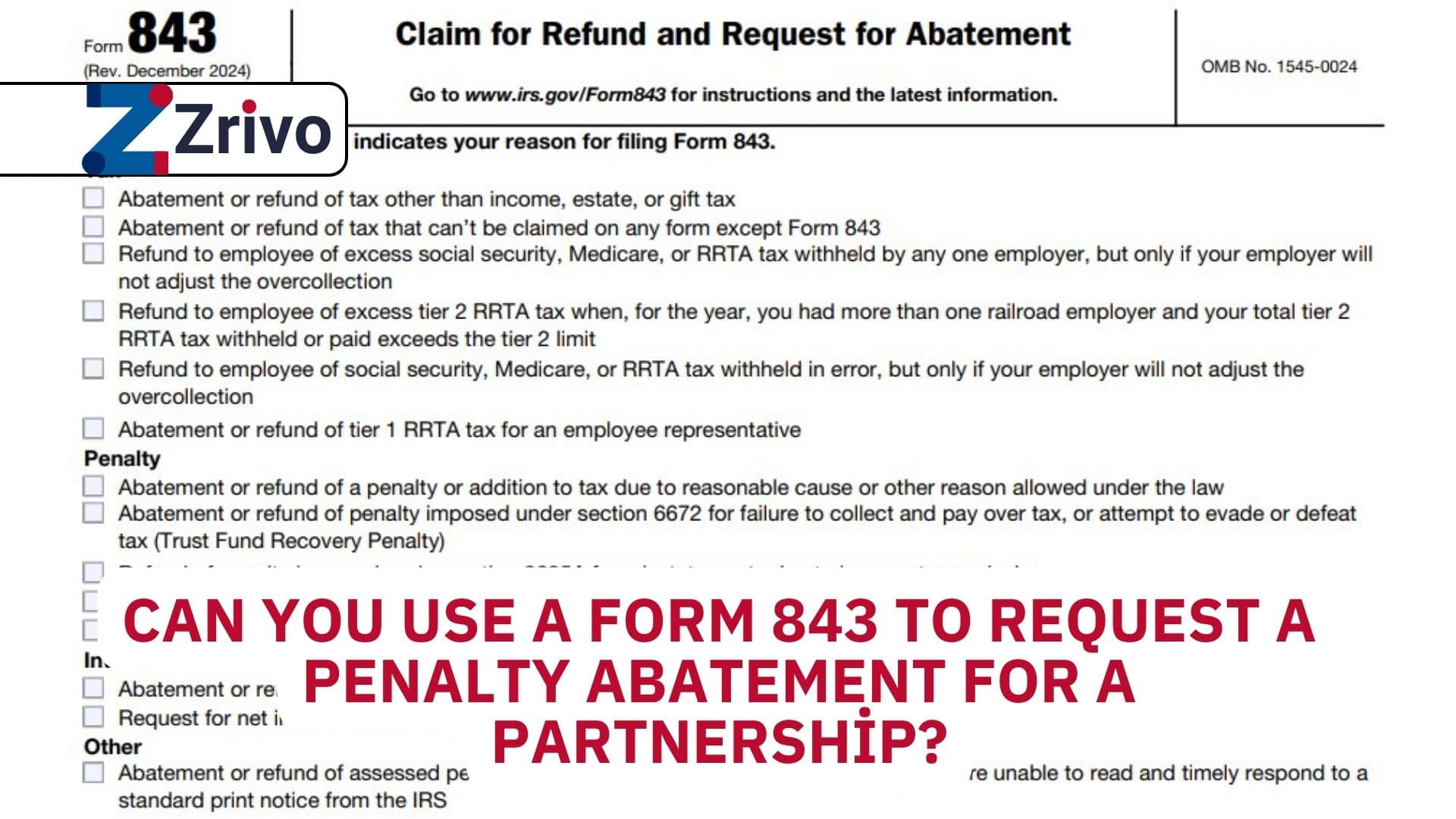

If your partnership has recently faced IRS penalties, you might be asking yourself, “Can you use a Form 843 to request a penalty abatement for a partnership?” Understanding IRS penalty abatement procedures can be tricky, especially when dealing with partnership tax returns. Form 843, known as the Claim for Refund and Request for Abatement, is commonly used by taxpayers to request relief from certain taxes, penalties, fees, and interest. However, when it comes to partnerships specifically, the situation becomes slightly more nuanced. Partnerships may face penalties for late filing or failing to provide accurate information on their tax returns (Form 1065). Knowing whether Form 843 is the right choice or if alternative methods apply can save your partnership significant time, money, and stress. This article will clarify exactly when and how partnerships can use Form 843 or other IRS-approved methods to request penalty abatement, ensuring you’re fully informed about your options.

What is IRS Form 843?

Form 843 is an official IRS document designed to help taxpayers request refunds or abatements for penalties, taxes, fees, and interest. Typically, individuals and businesses use this form when they believe they’ve been unfairly charged due to IRS errors, delays, or reasonable cause justifications.

Can Partnerships Use Form 843 for Penalty Abatement?

While Form 843 is widely used by individuals and businesses alike, partnerships have specific rules governing penalty abatement. Generally speaking, partnerships facing penalties related to late filing (such as those under IRC §6698) can indeed use Form 843 to request penalty abatement based on reasonable cause or other allowable reasons.

However, it’s important to note that partnerships have additional avenues for penalty relief that might be simpler and more straightforward than filing Form 843 directly—such as relief under Revenue Procedure 84-35 or the First-Time Penalty Abatement (FTA) program.

Alternative Penalty Relief Options for Partnerships

Revenue Procedure 84-35 Relief

Revenue Procedure 84-35 provides automatic penalty relief specifically tailored for small partnerships meeting certain criteria:

- The partnership consists of 10 or fewer partners.

- All partners are individual U.S. residents.

- Each partner has reported their share of income timely on their personal tax returns.

- The partnership has not elected consolidated audit procedures.

If these conditions are met, the IRS presumes “reasonable cause,” granting automatic penalty relief without requiring extensive documentation.

First-Time Penalty Abatement (FTA)

The First-Time Penalty Abatement waiver offers relief if your partnership has maintained compliance over the past three years. To qualify:

- Your partnership must have no prior penalties within the previous three tax years.

- All required returns must have been filed timely (or extensions filed).

- Any outstanding taxes must be paid or arranged through an installment agreement.

This administrative waiver can often be requested simply by contacting the IRS directly rather than filing Form 843.

When Should You File Form 843?

Form 843 becomes particularly useful when:

- Revenue Procedure 84-35 relief doesn’t apply or was denied.

- Your partnership doesn’t qualify for FTA.

- The penalty resulted from incorrect written advice from the IRS.

- You prefer formal documentation of your abatement request.

In these scenarios, filing Form 843 ensures a clear paper trail and formalizes your request for relief based on reasonable cause or IRS error.

Completing Form 843: Quick Tips

When filling out Form 843:

- Clearly specify the tax period related to the penalty.

- Indicate the exact amount you’re requesting to abate.

- Provide the relevant IRC section number (usually found on your IRS notice).

- Clearly state your reason—typically “reasonable cause” unless there’s an IRS error involved.

- Include supporting documentation explaining why the penalty should be abated.

FAQs:

Can all partnerships use Revenue Procedure 84-35 relief?

No. Only small partnerships with ten or fewer individual U.S. resident partners qualify automatically.

Is it mandatory to file Form 843 for partnership penalty abatements?

No. You can also request abatements through direct correspondence or phone calls with the IRS.

How long does it take for the IRS to respond to a Form 843 submission?

Typically several weeks up to a few months depending on complexity and backlog

Can I appeal if my Form 843 request is denied?

Yes. You have appeal rights if you disagree with the initial decision from the IRS.