1099-MISC Form Miscellaneous Income

Contents

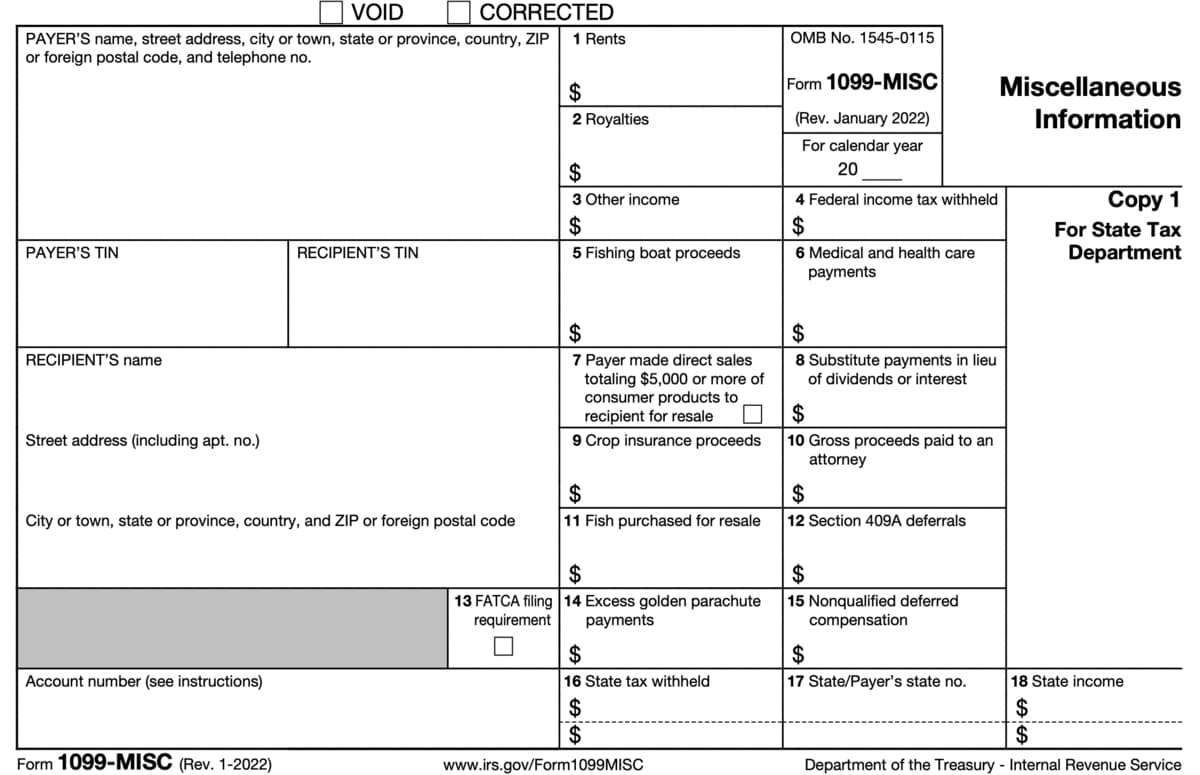

Form 1099-MISC, Miscellaneous Income, is an information return that reports a wide variety of income types. Payers that paid certain types of income must file Form 1099-MISC to report this to the payee and the Internal Revenue Service by January 31. It is by far the most commonly used Form 1099 that covers a variety of incomes.

However, if you’re using it to report income paid to an independent contractor or a freelancer, it might be best to use the 1099-NEC instead. Read more about the uses of Form 1099-NEC here.

Types of income reported with 1099-MISC

According to the Internal Revenue Service’s website, use Form 1099-MISC to report the following types of income.

- Any fishing boat proceeds.

- Cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish.

- Crop insurance proceeds.

- Generally, the cash paid from a notional principal contract to an individual, partnership, or estate.

- Medical and health care payments.

- Other income payments.

- Payments to an attorney.

- Prizes and awards.

- Rents.

Payers that paid at least $600 in the above payment types must file Form 1099-MISC. However, if you paid royalties or broker payments in lieu of tax-exempt interest or dividends, this income limit is $10.

File Form 1099-MISC online

The TaxUni PDF editor allows taxpayers to file certain tax forms online as if they were filling out a copy on paper. This does not replace e-filing. Once filed through here, you need to print out a paper copy and file it with the Internal Revenue Service. In e-filing, you file it and don’t have to mail the tax forms to the Internal Revenue Service. That said, this is basically paper filing, but on your computer, which is convenient and time-efficient.

Start filing Form 1099-MISC below.

Note that you cannot use the copy that appears in red to file with the Internal Revenue Service. Instead, order the tax forms from the IRS that are scannable.

Important things to know about 1099-MISC

The information provided on Form 1099-MISC isn’t sent to the Internal Revenue Service directly. It’s a rather different process with the 1099s. You need to file with Form 1096 to transmit all the 1099-MISCs you filed during the tax year. Read more about how to report Forms 1099s using 1096 here.

Deadline to file Form 1099-MISC

Form 1099-MISC is due on January 31 for the payee. This means you need to file a copy of Form 1099-MISC and furnish the copy with the payee by the deadline so that they can get going with their federal income tax returns as they need this document to report the total income they earned.

The penalties for late filing are the same as pretty much any other information return. You pay $50 per violation if you file the copy within 30 days after the deadline. For 1099-MISCs filed before August 1, the penalty is $110 per form. After August 1, the monetary penalty becomes $270, and willingly neglecting filing Form 1099-MISC brings you a penalty upwards of $500. The maximum penalty is $556,500 per year.

Reporting freelance income, 1099-MISC or 1099-NEC?

When reporting income paid to a non-employee, it might be best to use Form 1099-NEC if you’re not filing Form 1099-MISC for any other purpose. If there are 1099-MISC you need to file, report the income paid to freelancers and independent contractors using the same form. The reasoning for this is that you are required to report each variation of 1099 filed using 1096, filing a separate 1099-NEC means you’ll do more tax work.

Do I have to file Form 1099-MISC to handymen, such as plumbers, gardeners, etc.?

The general idea is that if you’re in a trade or business, you must file Form 1099 for payments that exceed $600. Assume you hired an independent contractor to clean the HVAC filters at your office and paid $400 for the work in total. You then never called in the same contractor to do any work for you for the remainder of the tax year. However, if you call in the same person to do another work and the total payments exceed $600, you are then required to file Form 1099-MISC and furnish a copy to them. You will want to do this as you won’t get a tax cut for the repairs/maintenance for your workplace.

I received a 1099-MISC, what do I do with it?

Use the 1099-MISC you received to report your gross income on your federal and state income tax return. If taxes were withheld from the income, use it to report your total payments. You will then need to attach the 1099-MISC to your tax return. Since the IRS knows this income, make sure to go over your 1099s with care and make sure to enter all reported income on your tax return.

Do I have to file Form 1099-MISC for under $600?

You are only required to file Form 1099-MISC under $600 for the royalties and broker payments in lieu of tax-exempt interest or dividends when the payment exceeds $10. Other than this, you aren’t required to file Form 1099-MISC for payments under $600. Still, this doesn’t mean that you can’t. You can still file and report income paid on 1099-MISC. Do this in cases when the payment made is deductible so that you get a tax cut.