IRS

The general information and documents that taxpayers need from the Internal Revenue Service. Learn announcements from the agency regarding your personal and business taxes.

-

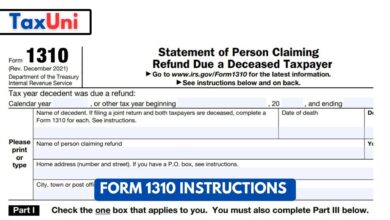

Form 1310 Instructions

Form 1310 is a form that must accompany a deceased taxpayer’s final income tax return when a refund check is…

-

Pub 501

IRS Publication 501 (Pub 501), titled “Dependents, Standard Deduction, and Filing Information,” is a comprehensive resource that provides detailed guidance…

-

Pub 969

IRS Publication 969, Health Savings Accounts and Other Tax-Favored Health Plans provides general rules regarding Health Savings Accounts (HSAs) —…

-

IRS Account Transcript Code 971

IRS Account Transcript Code 971 indicates that the IRS has issued a notice to the taxpayer, such as a notice…

-

IRS Account Transcript Code 152

If you’re looking to file your taxes this year, you might have encountered the IRS Account Transcript Code 152, which…

-

IRS Account Transcript Code 806

IRS transcripts are detailed records of a taxpayer’s reported income and tax payments. They also include details on the status…

-

IRS Account Transcript Code 150

After filing your tax return, you’re able to access a free IRS transcript. This transcript contains information regarding your returns…

-

Tax Inflation Adjustments

The IRS announced this week that it’s making annual inflation adjustments to more than 60 tax provisions for the filing…

-

Benefits of Filing Taxes on Time

Filing your taxes on time is important because it helps the government regulate the economy. It also provides health, education,…

-

Form 941 Schedule B

Schedule B of Form 941 is an attachment of your Quarterly Federal Tax Return. File it with your Form 941…